We are officially in a bear market.

The S&P 500 has now fallen by more than 20 percent from its previous high.

But what does that mean going forward?

I certainly don’t know for sure, but I know what the data tells us.

“Let me state the general principle, in no uncertain terms: the only way to be assured of capturing the full permanent return of equities is to ride out every day of their temporary declines. It is simply not possible for anyone consistently to gain a timing advantage over the market by going into and out of it.” - Nick Murray

Here are five lessons I think investors should remember during times like this.

1) Stocks are, without doubt, the best long-term investment there is

There is no asset class that outperforms stocks over the long run.

None.

They outperform bonds. They outperform commodities. They outperform cash.

There's quite simply nothing you can invest in that has more evidence to support its long-term performance.

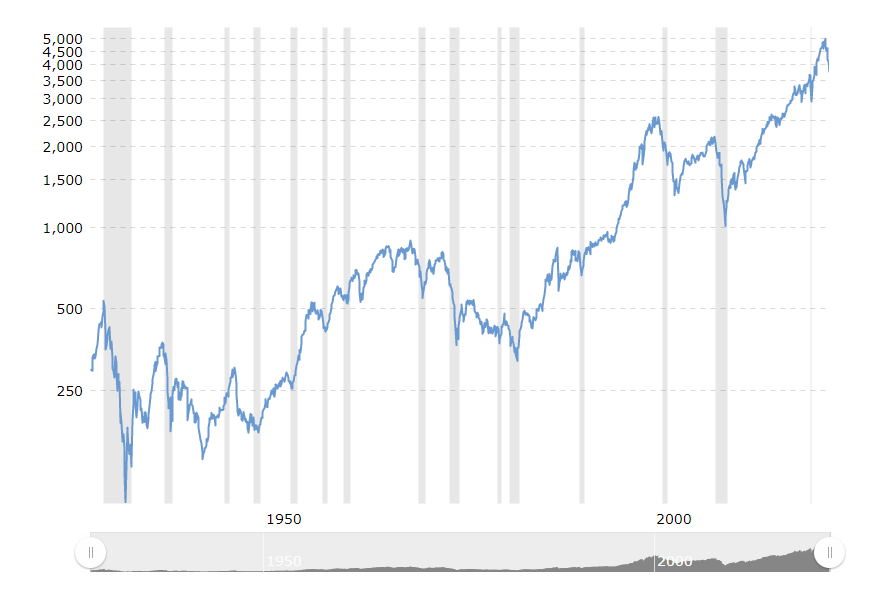

The chart below from Macro Trends demonstrates this.

Look at the recent decline.

Though it may not feel like it right now, it’s a small, inconsequential dip.

The same thing will be true whether we get a 25%, 30% or 40% decline.

Even 2008 looks minor relative to the long-term returns.

Of course, this involves risk and having the stomach to remain invested, no matter what.

Volatility is simply the entry price to be able to enjoy future long-term returns.

2) Comparisons are dangerous

Last week alone, I saw the current bear market compared to four different markets in history.

- The 1970s, due to high inflation.

- 2000, because that bear market was driven by technology overvaluation.

- 2008, because they see a more significant crisis coming.

- Some even forecast a repeat of the Great Depression.

But the reality is every bear market will ride out on its own path.

History rarely repeats itself exactly.

3) Time is on your side

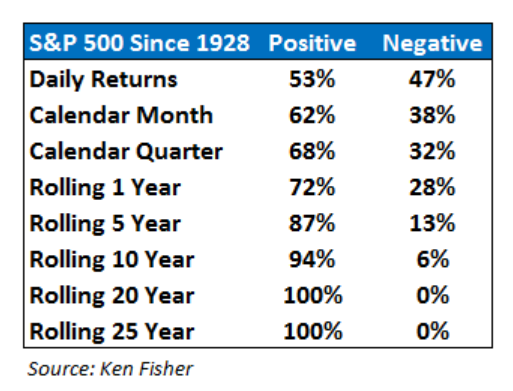

As Matt Hall, author of Odds On would say, take the long view.

Daily, stock returns are neither here nor there. Over a year, the odds are about 70% in your favour. Over 20 years, the odds are overwhelmingly good.

Nothing is certain in investing so we can’t take these historical statistics and imply the future will look the same as the past. But either way, the longer your horizon, the greater your odds.

4) If you want to see the view, you must climb the mountain

There’ll be no definitive signal when the bear market is over.

When it is, it’s likely the economy will be a mess.

Before though, many forecasters will be telling us it is going to get much worse.

Again, data can help us see how much worse it might get.

When looking at a handful of “near” bear markets since World War II, we can calculate the average drop as being almost 29 percent.

Bear markets also tend to last about a year.

But they aren’t always that deep, drawn out, or memorable.

It’s also likely many will be questioning whether stocks are worth investing in anymore. If you’re waiting for the green light that it is safe to invest, you aren’t likely to get it.

My opinion remains the same, the best time to invest was yesterday.

5) Belief in your plan (and planner) is essential

The most important thing about investing is often not what you invest in, but the conviction you have in the process.

Conviction is what allows you to stick with your plan when times get bad.

If you begin to question your investment approach during periods of market decline and volatility, you won’t stick with it.

If you don’t stick with your plan, you won’t achieve your goals.

If your financial plan makes sense given your goals and risk tolerance, and you believe in it, then you will probably be feeling relatively calm when seas get choppy.

In fact, you will likely use those periods (like we are seeing now) as opportunities to add to your investments.

In the end, no one knows where we go from here.

The Fed may interject. They may not.

Inflation may spiral out of control. It may dissipate faster than many believe.

Whatever comes next, the key to being a long-term (successful) investor is just that...

Sticking to the long-term.

It’s about context.

It’s about achieving your investing goals.

I specialise in fixing broken investment portfolios.

You may not even be aware of the issues, but isn't it worth a second opinion?