Fad stocks have garnered attention for returns recently.

And while they’ll likely be around forever, in some form or another…

Most of them don’t reliably build wealth over the long term.

Fad investments arrive like a flash.

They generate buzz on the promise of fast money, get people worked up and then fizzle out—leaving investors in their wake.

Take the software company, Zoom.

In Autumn 2020, perhaps understandably, Zoom’s market capitalisation exceeded that of Exxon Mobil. That’s despite Exxon’s 12 billion barrels of proven oil reserves, as well as its vast array of other tangible and intangible assets.

Today, 18 months later, the market cap of Zoom is less than one-tenth that of Exxon. With the benefit of hindsight, it’s easy to say that selling Zoom and buying Exxon was a no-brainer.

But it’s never that easy.

Building wealth for retirement through highly speculative investments is almost never a good idea, and it rarely leads to consistent gains over the long term, as countless people have learned the hard way.

And yet, speculative fad investments keep coming.

Below I explore three of the biggest fashionable investments, and what the data tells us about their success over the long term.

1. Crypto

Described on HBO as “everything you don’t understand about money combined with everything you don’t understand about computers”, Bitcoin and related cryptocurrencies (now numbering in the thousands) are the subject of much debate and fascination.

In its relatively short existence, bitcoin has proved extraordinarily volatile, sometimes gaining or losing more than 40% in price in a month or two.

This month, we experienced “one of the biggest catastrophes crypto has ever seen".

It’s currently down around 30%, reporting losses of around $50bn in 3 days.

Some now believe (or hope) that this shows crypto should completely burn down, given that the sector has failed to live up to its promise of offering a reliable store of wealth.

Any asset subject to such sharp swings may be attractive for traders, but of limited value either as a reliable medium to replace cash, or as a risk-reducing or inflation-hedging asset in a diversified portfolio.

2. Oil

Oil might seem great now.

The industry rebounded strongly throughout 2021, with oil prices reaching their highest levels in six years.

This year, because of war-related trade and production disruptions, the price of Brent crude oil is expected to average $100 a barrel, its highest level since 2013 and an increase of more than 40 percent compared to 2021.

Some of the biggest companies in the world are oil and gas producers, including ExxonMobil and Royal Dutch Shell.

But just because you've heard of a stock or a company, doesn't mean it's a good investment.

The oil and gas industry has experienced significant volatility over the past several years, leaving energy investors wondering whether oil companies (even top oil companies) are smart investments right now.

Oil investments are generally considered riskier than other sectors, because of the industry's additional risk factors, including cyclicality, volatility, uncertainty, environmental issues and safety concerns.

Cast your mind back to April 2020, when the price of crude oil dropped to below $0 a barrel, for the first time in history. This meant you had to pay someone to take the oil off you.

Short term performance shouldn’t cloud long-term volatility. The price of a barrel of crude varies based on all the above factors. This makes it a highly volatile commodity and not a solid foundation for a long-term financial plan.

3. Gold

To quote the world’s greatest investor, Warren Buffett:

“Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid you make money, if they become less afraid you lose money, but the gold itself doesn’t produce anything."

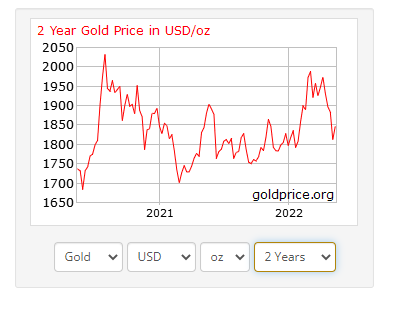

This can be seen in this charts, showing the 2-year and 10-year gold price in USD/oz:

But how about as a hedge against inflation?

This worked wonders in the 1970s, rising more than 1,300% or 31% per year.

Even after accounting for 7% annual inflation, gold was up more than 23% per year.

So, gold must be a wonderful inflation hedge, right?

Since the start of 2020, we’ve had the highest inflation rate in four decades, and gold is flat.

One dollar in 1980 would be worth 44 cents by 1999, because of inflation.

Gold was down 43% in this two-decade period.

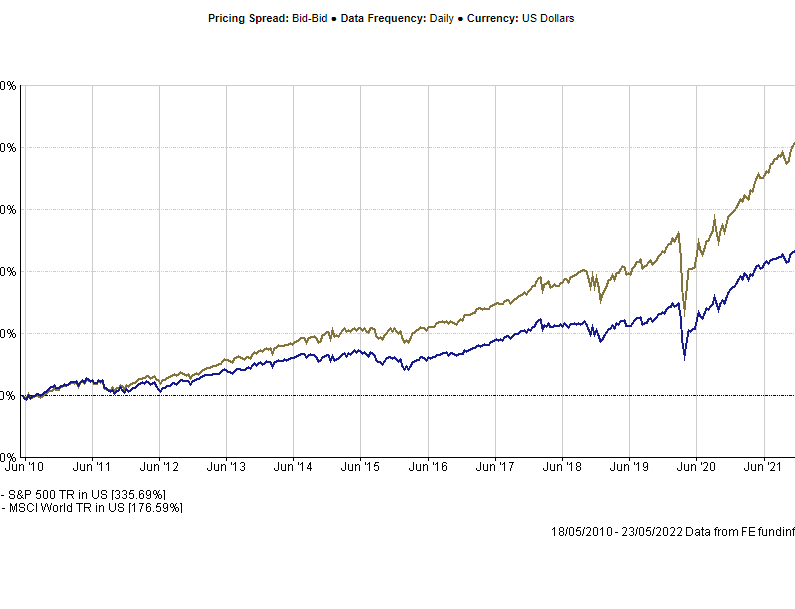

By contrast, the S&P 500 is up almost 3,500% since 1980.

In comparison, gold is up 448%.

There are no perfect assets. Nothing hedges you against every single risk, at all times.

Investing involves uncertainty.

And you can’t protect your portfolio from every risk.

The good news is once you realise there are no perfect assets, you can begin to create a portfolio that considers the fact that nothing works always and forever in the markets.

However, if we compare the above asset classes to equities across the long term, we build a picture of the true driver of returns.

Value vs. Growth investing: Which should you buy?

Value investing and growth investing are very different.

A value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales.

This makes it appealing to value investors.

A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market.

Usually, value stocks present an opportunity to buy shares below their actual value, and growth stocks exhibit above-average revenue and earnings growth potential.

Some stocks have elements of both value and growth.

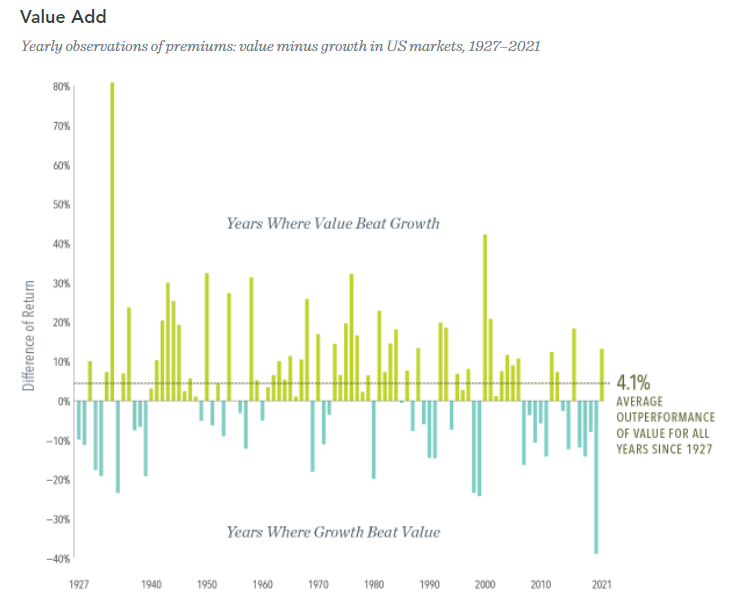

But there is pervasive historical evidence of value stocks outperforming growth stocks:

Value investing is based on the premise that paying less for a set of future cash flows is associated with a higher expected return.

That’s one of the most fundamental tenets of investing.

Combined with the long series of empirical data on the value premium, research from Dimensional Fund Advisors shows that value investing continues to be a reliable way for investors to increase expected returns going forward.

And right now, growth is underperforming value.

High profile losers year-to-date, such as Amazon (down 36%), Tesla (down 43%) and Netflix (down 68%) represent the big “style rotation” that we’ve seen this year, with the “growth” style down by around 24% YTD and “value” down by 7.8% (at the time of writing).

We believe investors are best served by making decisions based on sound economic principles supported by a preponderance of evidence.

While documenting trends in finance is entertaining, there is little evidence that investors can spot these trends in advance in a way that would enable market-beating performance.

Bets on high-flying stocks can expose investors to risks and a wider range of possible outcomes.

Both DIY investors and fund managers have both been bested by the stock market, since the pandemic.

A sound investment approach based on financial science, emphasises the importance of broadly diversified portfolios that provide exposure to a vast array of companies and sectors to help manage risks, increase flexibility in implementation, and increase the reliability of outcomes.

If you'd like a second opinion on your portfolio or have a nagging feeling your investments should be performing better, get in touch.