Lagging performance by active fund managers isn't a new story.

Neither is concern over fees charged or value added by working with financial professionals.

But is the solution to DIY?

This is the path some of the international investors I speak to choose.

Investors who are stewards of wealth with many important responsibilities and accountabilities...

But the complexities of that stewardship go well beyond the capacity of any one person.

And while well-off DIY investors may have beaten fund managers since the pandemic...

The stock markets have bested both.

Successful wealth management has many ingredients.

Wealthy individuals who choose to DIY are not only required to have sufficient expertise in capital markets...

But also in portfolio management, tax, estate planning, philanthropy, business management and even family dynamics.

There is also then the challenge of ensuring their goals are aligned to their capital.

Being a financial planner, you'd expect me to say that.

But, as the Dunning-Kruger effect tells us...

We have no idea how much we do not know.

So, while there are countless studies which prove behaviour and emotions impact DIY investor returns...

Not to mention motivation and knowledge...

For this blog, I just want to focus on capital markets, and what the data is showing us about how well they are performing.

A torrid time for markets

The horror unfolding in Ukraine has topped off what was already a difficult time in the markets.

It's no surprise to see the first quarter of the year chart negative average returns.

But how have DIY investors fared?

According to Morningstar, they're down 3.6% over the last 3 months alone...

And fund managers 3.7%.

While there are similarities to past downturns, this one is also unique in its own way.

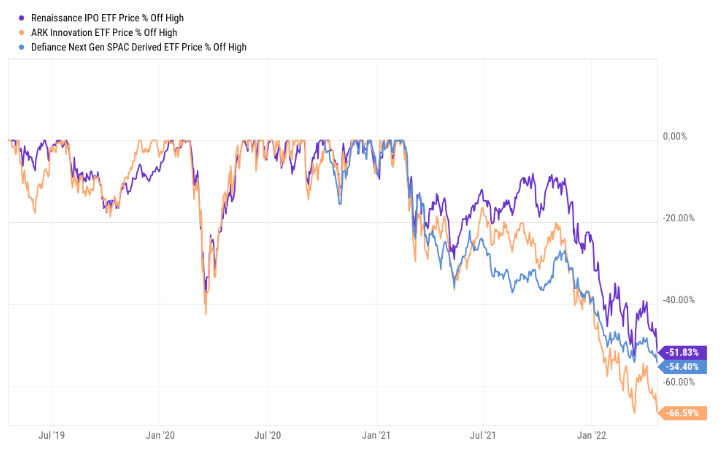

The speculative stocks DIY investors and fund managers loved to pick in 2020, continue to be beaten.

But they're not alone.

It would appear households are looking to spend less...

As mighty companies like Facebook, Netflix, PayPal and Shopify are struggling.

In fact, these four companies alone have lost more than $1.2 trillion in market value in less than a year.

For those investors who choose to DIY

The Financial Times recently explained:

"Stock pickers are doing exactly what one might expect when lower growth and diminished risk appetites are on their way. They are getting defensive. Since the market hit its last peak at the end of March, value has outperformed growth, consumer staples have outperformed consumer discretionary, and tech has been slapped around."

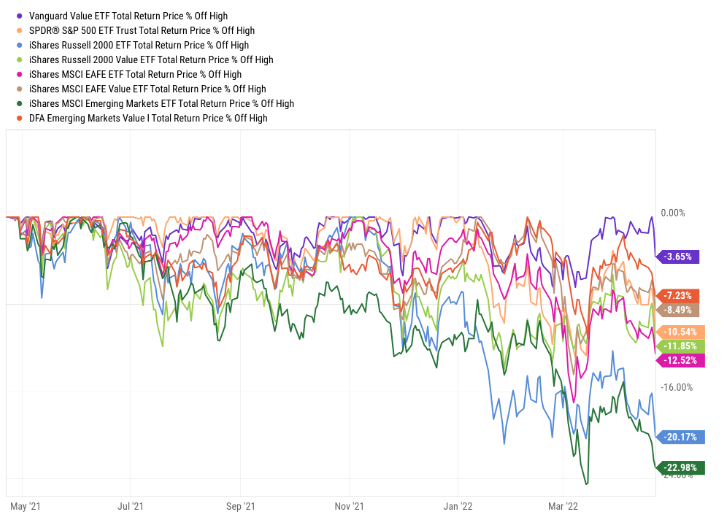

How does this compare to my clients, who are highly diversified and investing systematically over the long term?

Despite tech stocks making up a bigger part of the stock market than ever before, the S&P 500 remains resilient.

As the table below suggests, over the last 3 months, a client with a £1 million portfolio would be down £20,000.

| Performance to 31.3.22 | IA mixed investment 4-85% shares (fund managers) | Average Interactive Investor customer (DIY) |

FTSE World TR GBP |

| 3 months | -3.7 | -3.6 | -2.0 |

| 6 months | -1.0 | -1.0 | 4.8 |

| 1 year | 5.3 | 5.4 | 14.9 |

| 2 years | 33.2 | 39.7 | 60.8 |

| 27 months | 12.9 | 10.8 | 34.8 |

Source: FTSE Index performance, and IA index performance is source: Morningstar.

A DIY investor with the same would be down £36,000.

Using an active fund manager would have resulted in losses of £37,000.

What about over the longer term?

The average DIY investor with a £1 million portfolio would be up £10,800 over the last 27 months, compared to £34,800 for a systematic investor, following a plan of low-cost diversified investments, with the help of a fiduciary financial planner.

How is this possible?

From a capital markets point of view, value stocks are finally shining.

Perhaps the strangest development for investors right now is what’s happening in the bond market.

For decades, loss-averse investors have become accustomed to bonds acting as a safe haven.

Those conservatively invested may be less accustomed to simultaneous stock and bond drawdowns, like the ones we have seen in Q1.

Markets don't go up in a straight line

Now is a sobering reminder of that.

It's also a reminder of the importance of taking a long-term view, and not putting all your eggs in any one regional basket.

With more questions than answers for many investors in the current uncertain environment, there remain few alternative options beyond the stock market for those who want long term growth and income.

And working with a Chartered Financial Planner, who can protect you from your own emotions, will more than cover their annual fee via the higher returns you’ll get from staying invested.

The challenge is building a weatherproof, balanced portfolio.

If you'd like a second opinion on your DIY portfolio, or have a nagging feeling your investments should be performing better, get in touch.