I often talk about how our capital needs to be aligned with the goals and objectives we have.

Because investing is about you, not the markets.

Some goals are universal.

Most are deeply personal.

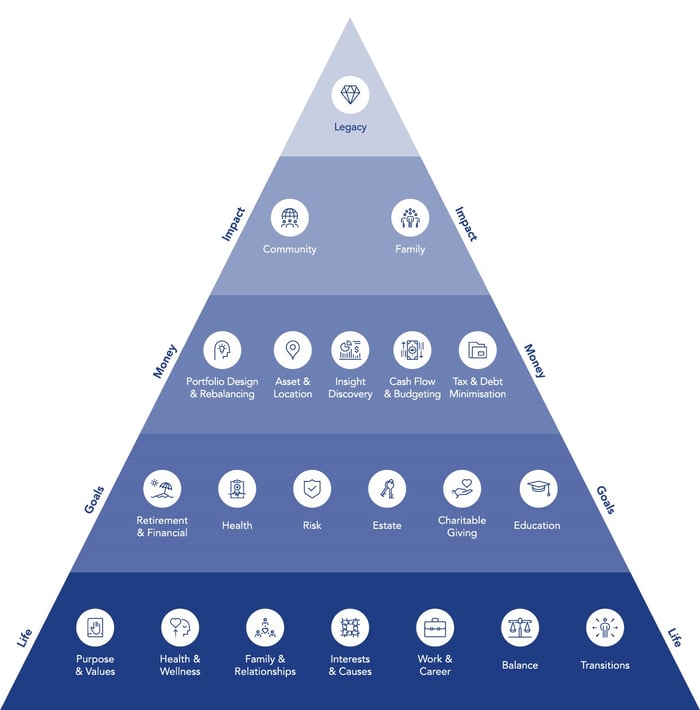

Although goals vary greatly from person to person, they can be organised within a formal investing framework.

You’re no doubt familiar with Maslow’s hierarchy of needs (or goals).

Humans start with fulfilling their basic needs: food and shelter for themselves and their families.

Once achieved, they seek success in their jobs, businesses, and communities – becoming a bigger part of a social structure.

Finally, they aspire to differentiate themselves through individual achievement: to leave a legacy.

This basic structure also lends itself to investment goals.

In the Wealth Allocation Framework (which categorises resources according to their intended purpose and shared risk-return characteristics), goals fall into one of three categories: essential, important, and aspirational.

1. Essential goals must be achieved, or else there will be devastating consequences: food may not get on the table, a home or a business will be lost.

2. Next come the goals that are not essential, but important. These come once the essentials have been taken care of.

3. Aspirational goals are those that may or may not be beyond our current reach. Creating something new, starting or scaling up a business, funding a project to help a community or our planet: all these can fall into this category.

Different people may classify the same goal differently.

Depending on your wealth level and your life philosophy, a goal such as “putting your kids through college” or even “creating a charitable foundation” may get labelled as essential, important, or aspirational.

Financial planning is about helping you stop, reflect and consider what you really want out of life.

Uncovering dreams, hopes, aspirations and passions, then building a plan to help you get there.

This is financial planning – not planning for money but planning for life.

For us, it looks like this:

Why are you investing?

What do you hope to achieve?

What do you need to achieve?

To translate each goal into an investment strategy you must begin by defining failure and success.

This is accomplished by translating each specific objective into desired cash flows or, especially in the case of aspirational goals, the desired outcome.

The desired outcome, for example, may be achieving a specific wealth level or transforming a community less fortunate than your own.

Certain goals may also exist to confirm things, for example making sure all of your investments reflect your values.

A business owner would be well versed in creating a goal-setting process, through strategic planning documents that reflect their mission statements.

These goals also fit nicely into the three categories discussed earlier and generally sit alongside a formal investment policy that outlines the risk-return objectives of the portfolio, as well as additional guidelines that are consistent with their original goals or mission statement.

I encourage individuals and families of all wealth levels to do the same!

Once defining and categorising your goals is done, you can move over to organising your capital to work towards the achievement of these goals.

I, along with my colleagues, have a personal Accountability Document that lists mine.

Of course, it’s impossible to estimate what return the market will provide in the future.

So how much should you allocate to the markets?

How big a house can you buy?

You can organise your assets into 3 buckets:

1. Safety (do not jeopardise the basic standard of living) – takes little risk, provides protection, but little market return.

2. Markets (maintain lifestyle) – a well-diversified portfolio will give a return, but we don’t know what that is. Not surprisingly, the value of these investments will go up and down.

3. Aspirational (enhance lifestyle) – this is optional but could well be the engine of wealth creation.

Next, categorise your entire balance sheet (assets and liabilities) into these three categories.

Then assume dire market conditions and see if your essential and important goals are compromised.

That will be an indication that there is too much risk in the portfolio.

Then do the reverse, and see if your most aspirational goals are achieved.

Repeating this process periodically, but not too often, is the key to creating a disciplined investment process oriented towards achieving your goals.

Are your investments appropriately allocated to achieve your goals?

If you’d like some help ensuring your goals (basic and essential) are realised through your capital, get in touch.