Why your flourishing future is at risk if you don't have a clear strategy for your life

Money conversations are my daily life.

Over the past twenty years, I’ve had thousands of conversations with successful, internationally-minded families.

These have armed me with the critical outcomes needed to achieve a flourishing future. This includes how different generations and demographics define success and what 'living their best life' means to them.

But the more conversations I have, the more I see people staying shallow...

Even when we know winning in life’s journey isn’t about ‘products’.

And 'managing your money' is only the tip of the iceberg.

For example, winning in life isn't about investing - which seems to get endless attention.

- “What's going to happen next year?“

- “Should I include gold in my portfolio?“

I'm not denying these are important questions, but the answers to them become apparent - eventually.

Tax is also a very popular topic.

- “Are my capital gains taxable?“

- “What happens if I move country?”

Again, important questions.

But they're like setting off up a mountain without first plotting the route, equipment needed or consulting with an experienced guide.

There are always far deeper conversations to be had about money and your success.

What should the focus be on instead?

It’s your life strategy (your cash flow).

That might sound boring.

But your life strategy is the foundation of EVERYTHING. All those catchy topics—investing, tax planning, all of it—come after you understand your life strategy.

A company doesn't run without accounts but humans often do, so it's perhaps not surprising matters can go awry.

We won't (and can't) crunch a single number until we've listened - to what motivates you, what worries you, where you are now and where you want to be.

Imagine plotting your destination into a sat nav. You'll be given various routes, each with their own unique differences and challenges.

This is exactly what a life strategy is like.

And, like everyone, you’ll be distracted by things along the way that don’t matter (which investment instrument or short-term market performance/outlooks).

But there are only four things in your financial life you can control:

- Spending – how much you’ll live on every day and how much you’ll spend to enjoy your life today and in the future

- Saving – how much money you’ll put away for the future (often called a ‘nest egg’)

- Timing – when and how you’ll make major financial changes, such as retiring, or pay for significant purchases, such as a house

- Taking risk – how much risk (or volatility) you’ll assume with both your money and your assets

It's these which we can test and adjust to ensure you meet your desired destination.

What is your life strategy?

In short, it's the only plan you'll need.

It takes into account what motivates you, what worries you, where you are now and where you want to be.

It answers questions like:

- How much is enough?

- Am I on track?

- Can I do this?

- Is my family protected?

- When can I afford to retire?

- What investment return do I need to meet my objectives?

- What happens to my family if I'm unable to work or I die?

- How much inheritance tax is payable on my estate?

- Can I afford it if my investments don’t perform as well as expected?

It's based on your situation and your goals. It will evolve over time.

Whether small or large, changes to your own circumstances, along with what happens in the markets, mean that over the years your life strategy will adapt from time to time.

An important part of this is your cash flow analysis.

Cash flow is simply your income minus your expenses.

The principles of 'paying yourself first', budgeting, or 'spending less than you earn' are all about having positive cash flow.

A negative cash flow means running out of money, and none of us want that.

But there are many moving parts, critical events, and noise in life, which make it easy to get distracted and allow your finances to drift off course.

Not all of us have the time to devise and execute an ongoing financial forecast, with all the complexities that can entail.

Lifetime cash flow modelling is a chance to pause, take stock, and evaluate your current financial position, helping you identify what's important in the short, medium and long term.

The numbers

Once we've answered 'what's the money for?', it's time to look at the numbers.

Every life strategy has many data inputs and assumptions.

The more accurate, realistic and current these are, the better the strategy will be.

There are some steps to consider here:

- Your family's assets and liabilities - cash, securities, property, companies, business cash flow and potential inheritances are your assets. Liabilities are unlikely to be debt, but rather the goals the family wants to achieve which need to be funded. The difference between the assets and liabilities is therefore the family net worth.

- Your family's income statement - gross income, less taxes, less expenses. Most people know what their income is, and tax can be calculated. Calculating expenses however, is trickier.

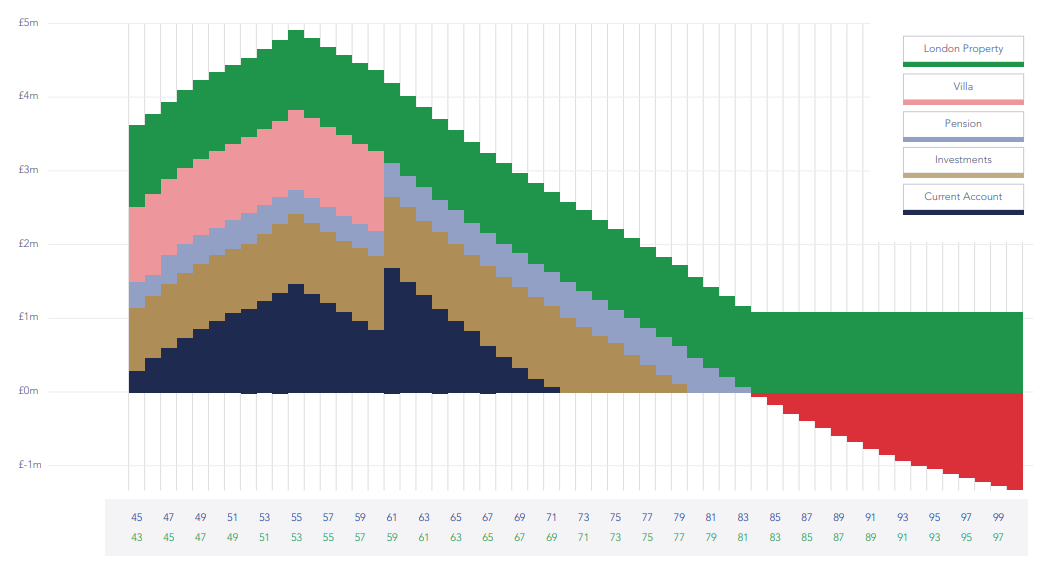

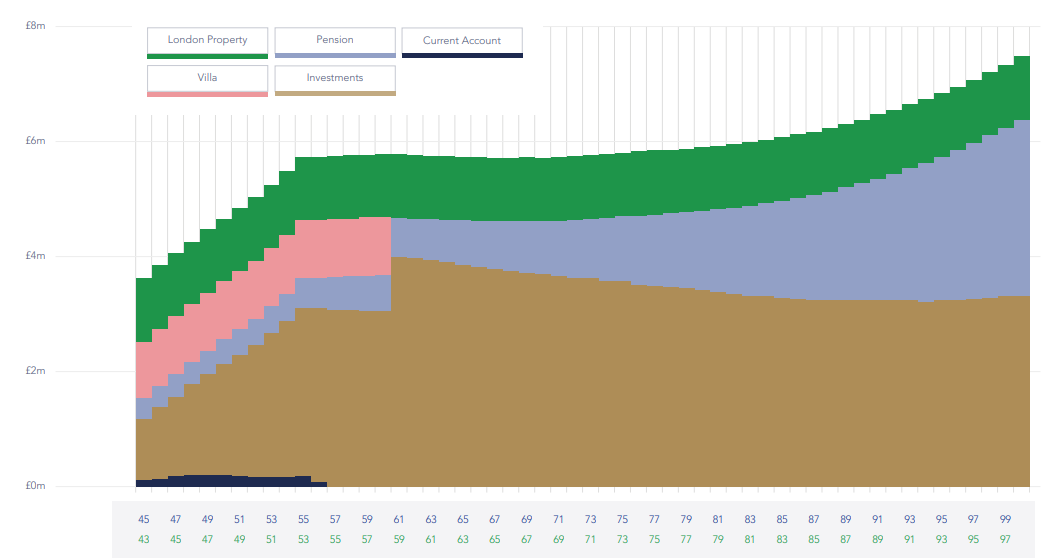

A cash flow might look like this to begin with:

Advanced cash flow analysis is often a good idea when you hit one of life’s many stages.

Examples include:

- Property structuring

- Disaster planning

- Death

- Divorce

- Business exits

- Long-term care

- Estate/IHT planning

A healthy cash flow means you can continue to systematically invest in the best companies of the world, or simply take that family trip making memories or help out your children or grandchildren.

You can’t manage what you don’t measure

Like flying, a successful investing journey requires constant course corrections to arrive at the correct destination.

To make the right changes, you need to track the correct numbers. As the management expert Peter Drucker once said,

“What gets measured, gets managed”.

By working with a sage guide who understands how these numbers interact, there's no reason you won't reach a flourishing future.

Below are some metrics we recommend you keep track of:

Your wealth window – quite simply, how many months until you hit your financial independence day? This is when working becomes optional for you. Knowing this number in months rather than years makes it feel more motivating for most people. For example, if you’re 52 and want to retire at 62, you have 120 months left in your wealth creation window.

Your saving percentage - what percentage of your take-home pay are you investing for the future? The more you can put away, the faster you can retire. Additionally, by putting away more, you learn to live on less. Successful investors routinely save more than 20% of their income.

What percentage of your investments are in global equities - in other words, owning shares in the great companies of the world. Using history as our guide, equities provide the best long-term returns. Ideally, you want to continually move closer to a 100% allocation to equities, but the more, the better.

Your retirement income needs - how much monthly income will you require in retirement to live comfortably? This will depend on your lifestyle and aspirations.

Your retirement income shortfall – simply, the difference between what you'll need and what your current expected retirement income is, possibly from a state pension or rental income. This is the number that your investment portfolio will need to provide. Your financial planner will be able to help you understand how big your portfolio will need to be.

What percentage of your income is protected – this is what disability and life insurance is for. We all think we’re invincible, but this is a serious topic. Too many people insure their phones but not their income.

Most of us have a poor handle on our cash flow

I've written before about how a poor handle on your life strategy can have detrimental affects, to even the brightest, highest earners.

How even those who have a positive cash flow each month, and technically spending less than they earn, rarely have a good understanding of their cash flow and are therefore not able to systematically invest in the best companies of the world.

Why?

Because income comprises one or two transactions per month. It’s easy to track.

But spending involves dozens of transactions per month.

Measuring that spending is tedious and easy to mess up. It frequently forces us to face painful conclusions like,

“The Peloton has spider webs on it. We haven’t used it in three months, but we’re still paying for it”.

It’s not fun to face that music. But you can’t manage what you don’t measure. You need to understand your spending to know your cash flow.

A cash flow analysis can also highlight unexpected outcomes which can alter your life strategy.

For example, it might show you have too much money - which may lead you to make different decisions, perhaps about philanthropy.

Or, it might show too little money to keep up with your current spending patterns. A change needs to be made to avoid running out of money in retirement.

For others, things might be 'just right' and all that's needed is someone to keep you on the path towards your ideal future.

A deep commitment

Financial life management is an ongoing process involving goal setting, cash flow planning, risk management, investing and many other elements. Terrific results require a deep commitment from you as well as your guide.

AES emphasises a client-centric approach through sage financial life management and systematic investment.

It acknowledges and addresses behavioural biases while highlighting inner drive and purpose.

That means the focus shifts from fear-driven planning, to a long-term, psychologically-informed life strategy.

True financial planning isn’t about products.

Or stock market speculation.

It's about planning, numbers and behaviour.

At least 90% of an investor’s personal lifetime return will be driven by:

- the primacy of a robust plan;

- how much of the portfolio is allotted to equities as opposed to bonds; and

- whether or not, in response to some extreme market fad or fear, you breaks faith with the plan.

All successful investing is goal-focussed and planning driven.

All failed investing is market-focussed and current outlook driven.

Successful investors act continuously on their plan.

Failed investors continually react to the markets, and always in the wrong way.

We’re here to provide sage guidance and fight to ensure we keep you on track.

Having a life strategy puts your life into perspective.

It's the best way to achieve clarity, confidence, and control on your future.

And you can rest assured it will always be the one reliable route to the future you want.