How two lawyers, currently earning $500,000, admit they struggle to make ends meet (case study plus our thoughts)

$500,000 a year is an enviable household salary.

That's around AED1.8 million.

Almost 16 times the UK average.

But it’s still not enough for one couple. Here's why.

Every day I talk to families about how to reach a flourishing future.

Of course, part of this has to involve looking at current finances and spending.

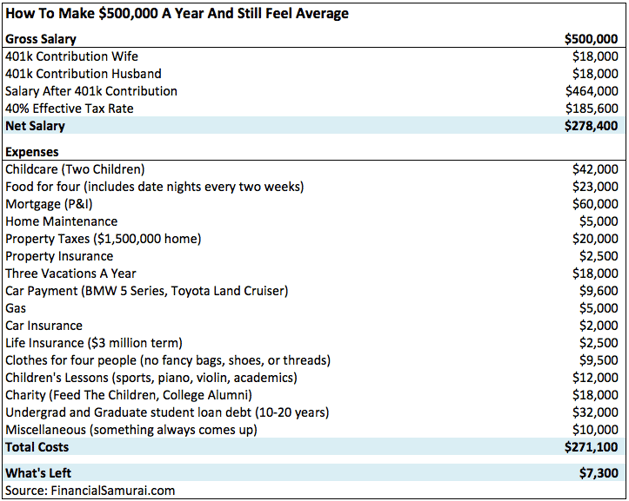

I saw an interesting article where one American couple shared their annual outgoings.

As high-earning, lawyers they have a combined salary of $500,000.

They also have 2 young children.

This is much like many of the law firm clients I have living and working in Dubai.

Their yearly expenses were laid out in black and white, a really interesting exercise I'd recommend everyone do.

Their total combined housing costs are around 31.4% of their net salary. Food is around 8% and transport, 6%. Notably, they're still paying off student loan debt and their healthcare costs are high (as a result of having two young children).

Let's take a closer look at some of their expenses.

Mortgage: $5,000 a month in mortgage expense bought this family a $1.5m, 1,700 square foot condo in Brooklyn a couple of years ago. In other words, they're living comfortably, but not large (however, the value of this has likely gone up in recent years).

After accounting for taxes, their mortgage, property taxes, and maintenance expenses are, not surprisingly, their biggest expense, at $87,000 per year.

Perhaps their jobs mean they have to live in New York City. And it's likely that $1.5m for a family of four isn't that extravagant there.

But would they be better renting? Here's a calculation to help work that out.

Childcare: They spend $42,000 a year on childcare.

I can certainly relate to children being expensive - more so in big cities.

Without children, a couple earning $500,000 would of course be better off.

Having said that, having more than one child does often come with discounts on childcare and school fees.

They also spend $1,000 per month on their kids' hobbies and activities. All parents want the best for their children - they likely believe this is money well spent.

As a father of three living in Dubai, I've certainly witnessed the competition and anxiety around extra-curricular activities and the role they may play in the future of our children.

Loans: A good education (shown in their $32,000 of student loan debt from law school) often doesn't come cheap. This is often the reality of those in high-paying jobs.

Food: Spending $23,000 a year on food equates to roughly $1,916 a month, or $63 a day for four, or $15.75 per person all meals. This doesn't seem unreasonable for a big city.

Cars: They both own two relatively high-end (but family-friendly) cars. But are these both necessary in a city with an efficient subway system? Could they save money here?

Holidays: This couple take three, $6,000 holidays per year. This's probably a reasonable expense given a family of 4, staying for one week in a 3-4 star hotel, including airfares. And of course, a work-life balance is important, particularly for those careers where burnout is a real risk.

It's also worth noting their large donations to charity.

The problem is not necessarily the types of purchases they make (after all their salaries can afford them), it’s the aggregate impact of all their expenses.

5 unique needs of lawyers

I look after a lot of international lawyers, mainly partners.

Their circumstances mean they have unique financial planning needs. The traditional 'rules of thumb' don't apply in the same way to maximise the value of their professional accomplishments.

In my mind, there are 5 unique aspects of this career and profession that are worth highlighting:

1. Wealth accumulation window

As a partner in a law firm, they're in a position to take advantage of the 'wealth accumulation window', where they'll be earning significantly for the foreseeable future. Their accelerating income, combined with a relatively short earning period, creates a rare tax-free savings opportunity that perhaps doesn't exist in their home country, nor in other careers.

2. Competing time demands

They're probably busier than ever, managing a number of competing priorities between work, travel and family life. These take precedence and therefore they don't have the time nor mental energy to manage their personal finances. Living overseas, they’ve probably heard numerous stories of people losing money to the wrong ‘adviser’ or others making the wrong financial decisions. They may even be impacted by this if they haven't been able to dedicate the necessary time and required due diligence.

3. Bonus structure

They likely benefit from significant annual bonuses and may feel these don't currently work hard enough for them. They may even be tempted to spend these without considering other potential uses. Their rapidly increasing compensation means they're likely saving more than ever, however it's easy to think that saving every month will be enough and not take action to maximise this earning period and any capital that is idle as cash.

4. Ability to process complex information

Their analytical capacity and attention to detail sets them apart. However, this can work both ways. On one hand, overconfidence is the worst enemy of the investor. Investing is the rare pursuit where being smarter than the next person does not necessarily translate into better performance.

This counter-intuitive fact has derailed many professionals. They maybe haven't properly considered the risk required to meet their goals, risk tolerance and risk capacity, potentially over-exposing themselves unnecessarily. On the other hand, they may understand and be comfortable with the critical tenets of financial planning. This doesn’t, however, take away from the fact they can't apply themselves to doing so on a consistent basis.

5. Time in retirement

The reality is that because of the demanding nature of the role, most notably the time and travel commitments required, it's unlikely that they'll continue working until ‘normal’ retirement age. Additionally, their desired spending may be well in excess of the average.

Funding retirement isn't just about living expenses; it also needs to take into account increased medical and long-term care costs. They’re in an incredible position to achieve their financial goals at a relatively young age thanks to their earning capabilities. This does, however, mean their retirement (or semi-retirement) could last 40 or more years. This too creates unique needs around wealth accumulation, preservation and transfer.

What this couple can do

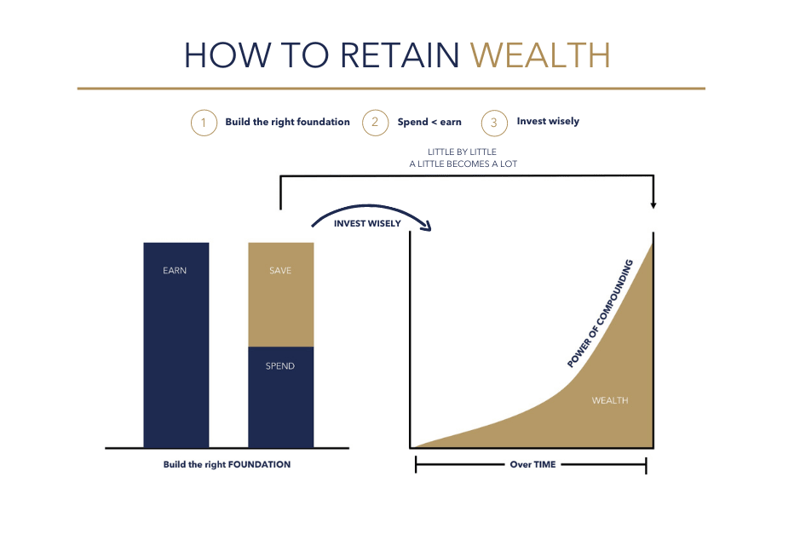

Now, back to our lawyers earning $500,000. There are 3 steps to wealth.

Spending less than you earn is step two.

Spending less than you earn is step two.

The key to this step is not the actual act of saving - it’s finding the money to save in the first place.

You could argue this couple is technically spending less than they earn…

They have $7,300 left, after all.

Remember, that's annual, so around $608 per month.

One unforeseen incident or extra expense, and that money is gone.

For me, that's not the most concerning thing about this couple's finances.

It's also not the fact that, other than their 401k (which they can't access before 59), this couple are not investing for their retirement.

Perhaps the most worrying line item missing from the above breakdown is that this couple are currently not able to save and invest for their children's' education.

The cost of university now is not going to be the same in 10 or 20 years' time. Anyone who plans to send their children to university needs to start saving as soon as possible.

And let's not forget, every day that passes, means missing the incredible power of compounding.

This couple are not extravagant spenders by any means.

But there are still costs that can be reviewed (say housing and cars) and honest conversations to be had about whether certain expenses are needs, wants or luxuries, following the 50/30/20 rule.

This isn't easy.

Proper financial planning should allow you to enjoy life now while making provision for your flourishing future.

You need analysis and perspective but most importantly you need access to the right type of information to empower your financial decisions.