What is group medical insurance?

Group medical insurance is an insurance policy paid for by a company which provides a certain level of health insurance for its staff, who are the 'members' of the policy. It typically lasts for one year before the policy is renewed, at which point the company can review the performance and service received and change the insurer providing the policy if it wishes. Policy members will usually be provided with a medical card and can access treatment at a certain range of hospitals and clinics listed on the policy, known as the 'network'. Using facilities outside this list is known as 'out of network'.

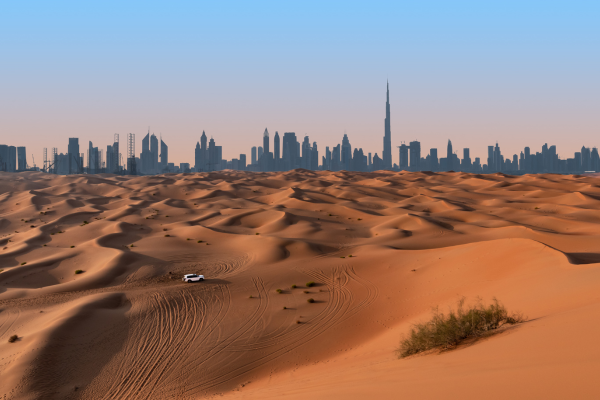

Why businesses need group health insurance in Dubai

It's mandatory for companies in Dubai to provide a level of medical insurance to employees. Covering the cost of medical cover also allows employees a level of security in the absence of universal healthcare, so they can better focus on work. A group policy is typically less expensive than an individual policy.

What are the benefits of group health insurance for businesses & employees?

Group medical insurance allows employees a level of security compared to the personal expense of medical cover, which is often much more expensive.

Businesses benefit from knowing that the cost burden of healthcare is taken away from employees, and employees are better able to commit to the company knowing this expense for themselves (and often their dependants) is covered.

Companies can combine the medical insurance with wellness programnmes that help staff make healthier choices, improving their work performance and reducing the claims made on the policy, saving the company in the long-run while remaining compliant.

Cost savings with group health insurance for employers

Companies pay less by purchasing a group medical policy for staff than reimbursing individual policies taken out by each member. It also reduces the company's risk, since it can choose the insurer and level of cover as opposed to reimbursing the different cost levels of very different insurance policies. Further, a company can better budget for the mandatory requirement of proving insurance with a group policy by paying annually, compared to individual policies that have different renewal dates.

How group medical insurance improves employee satisfaction and retention

Providing comprehensive group medical insurance shows employees that a company is invested in their health and well-being.

Employees can better commit to the company's mission knowing that the expense of medical care is covered, and benefit from getting fitter and healthier.

Surveys repeatedly show employees value these benefits, and are an important factor in why they stay at a company or why they would choose a company with a strong health culture.

Group medical insurance coverage: what’s included?

Group medical insurance generally contain certain 'essentials' of medical care. This includes outpatient (non-serious injuries and illnesses treated without needing to be admitted to a bed) and in-patient treatments, maternity care and others. The policy can also include extras, such as dental, physiotherapy and alternative medicine. The policy will have a 'network' of hospitals and clinics where members can get treatment without paying extra. Basic plans will have a shorter list of locations 'in network' than more expensive plans.

Group medical insurance plans in Dubai and the UAE

There are a wide range of insurance companies in the UAE.

This includes representative offices of global insurers, as well as several regional and local insurers.

An insurance broker that truly advises companies can offer guidance on the options available as per a company's needs, comparing tables of benefits on a like-for-like basis, and negotiating the final premium cost and benefits on behalf of the company.

Overview of group medical insurance plans for businesses

A group medical insurance policy is provided by an insurer. This is basically a contract that comes into existence when one party makes an offer to insure that's accepted by the other party. Company staff are members of the policy, and are covered by the insurance in accessing healthcare as per the limits of the coverage.

Companies can manage the cost of the insurance not just in comparing the premium offered by different insurers, but by adjusting the network, the range of medical services covered, the co-payment levels (instances where a member pays for some of the cost of treatment) and other areas.

A broker offering impartial advice can help companies choose the best plan for them and offer ongoing support to the members.

How to choose the best group health insurance plan in Dubai

An experienced broker truly acting in your best interest is the optimum way to select the best insurance plan.

They will know the insurers, their offerings and the relevant contacts at these companies.

An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers.

They can also help on managing the cost of claims by advising on the network, co-payment structures and ongoing staff feedback.

Group medical insurance for small businesses

Small companies of a minimum 6 members of staff are generally eligible for a group medical insurance policy.

Benefits of group medical insurance for small businesses in the UAE

A group medical insurance policy allows small businesses to remain compliant with regulation.

It also allows a more cost-effective and lower risk solution than reimbursing employees who take out their own individual policies.

Group benefits can also provide stability for a small company as it seeks to retain critical staff members and help the company grow. It can also help with business continuation, since employees can get treatment and not prolong illness or injuries.

A group policy can also help attract new talent to the company, potentially giving it an advantage over larger companies with a lower level of benefits on offer.

Affordable group health insurance plans for SMEs

There are many insurance providers in the UAE, and some will be more suitable for small companies than others, by being less expensive.

Also, certain aspects of the company itself - such as if it has high staff growth - may mean certain insurance policies are more suitable than others.

A broker offering impartial advice can help small businesses manage the cost of group medical insurance, as the issue of cost is not just the premium paid on Day 1, but the ongoing advice and support to manage costs through co-payments, network optimisation, and reducing absenteeism and claims through wellness initiatives.

Top health insurance companies for small businesses

There are many insurance companies providing cover for staff in the UAE. These range from global providers such as Cigna to regional insurers such as Sukoon, GIG Gulf, MaxHealth and Liva (previously National Life & General).

How to choose a group health insurance provider

There are many insurance providers offering health cover to businesses. Understanding the options available, the different products, the networks and benefits is not easy to achieve as a busy HR professional An experienced broker truly acting in your best interest is the optimum way to select the best insurance plan. They will know the insurers, their offerings and the relevant contacts at these companies. An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers. They can also help on managing the cost of claims by advising on the network, co-payment structures and ongoing staff feedback. they can also help get your members registered with the chosen insurer, among many other administrative tasks that make the process seamless.

What to look for in a group medical insurance provider

It's important that a company understands the products, track record and stability of any potential insurance provider. They will need to be comfortable the company is sufficiently regulated and compliant in its field. An experienced broker truly acting in your best interest is the optimum way to select the best insurance plan. They will know the insurers, their offerings and the relevant contacts at these companies.

Comparing group health insurance plans in the UAE

There are many insurance providers in the UAE. It can be a complex and time-consuming process. Basic internet searches often give little indication of the true options our there for a company. Also, the insurer used by one company may be less optimal than for another company. An experienced broker truly acting in your best interest is the optimum way to select the best insurance plan. They will know the insurers, their offerings and the relevant contacts at these companies. An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers. They can also help on managing the cost of claims by advising on the network, co-payment structures and ongoing staff feedback.

Role of a health insurance broker & consultant

An experienced broker truly giving advice is best placed to help a company select the best group insurance policy. An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers. They will know the insurers, their offerings and the relevant contacts at these companies. They can also help on managing the cost of claims by advising on the network, co-payment structures and ongoing staff feedback. A top consultant broker can also help install a culture of wellness throughout an organisation through tailored initiatives that engage staff and encourage them to make healthy choices. It can also advocate for key health checks and explain the offerings and expertise of the hospitals on a company's policy.

How can a business health insurance broker help?

An unbiased, experienced broker is the optimum way to select the best insurance plan.

They will know the insurers, their offerings and the relevant contacts at these companies.

An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers.

They can also help on managing claims costs by advising on the network, co-payment structures and ongoing staff feedback.

They can also help get your members registered with the chosen insurer, among many other administrative tasks that make the process seamless.

Why you need a health insurance adviser for group medical insurance

An experienced broker truly acting in your best interest is the optimum way to select the best insurance plan.

They will know the insurers, their offerings and the relevant contacts at these companies.

An adviser can understand a company's requirements and goals, and help compare like-for-like policies and providers.

They can also help on managing the cost of claims by advising on the network, co-payment structures and ongoing staff feedback.

They can also help get your members registered with the chosen insurer, among many other administrative tasks that make the process seamless.

How to buy group health insurance online

Companies can browse the websites of insurance companies and 'comparison' websites. But to truly achieve the required balance of benefits and budget, as well as ongoing support for when staff need the healthcare, it is best to engage with a broker acting as a true, impartial adviser.

The process of getting group health insurance in Dubai & the UAE

The first step to obtaining the best-fit health insurance plan is to engage with a broker giving true advice. They can learn from you your objectives, budget, benefits and hospital preferences and wider plans for your staff. The broker can help obtain quotes from different insurers that are applicable, comparing on a like for like basis. The broker can help you decide, negotiate with the chosen insurer, and provide support to register your members and other administrative support.

Understanding UAE health insurance regulations for businesses

All companies in the UAE must provide some level of medical insurance to their staff. An insurance broker truly giving advice can help a company stay compliant in these areas, both in terms of the benefits purchased as well as related documentation.

Group health insurance UAE FAQs

-

How is group health insurance different from individual health insurance?

Group health insurance is a policy that provides cover for all employees listed on a company's census which is submitted to the insurer. All employees should receive a medical card showing they are part of the policy, and are able to access treatment in hospitals and clinics in that policy's network. The company pays for this policy. Additional costs of treatment - such as specialist care not in the policy, or using facilities not in the network - is either paid by the company, or whole or in part by the employees, depending on the terms of the policy. Individual health insurance is a policy covering just a single person. It is paid for by the person and will also have a network of facilities and a range of included inpatient and out-patient treatments. Companies can usually

-

Is group medical insurance mandatory for businesses in Dubai and the UAE?

Yes, all companies must provide a certain level of medical insurance for their employees. An insurance broker acting as true adviser can help companies meet their compliance requirement in this area.

-

What factors affect the cost of group medical insurance plans?

The cost of medical insurance is influenced by many factors. The first of these is whether the coverage is local (ie, covered treatment is only available at facilities locally) or international (ie, the member can access healthcare when visiting a range of countries outside the UAE). The broader the geographic coverage, typically the more expensive the insurance. A second issue is the range of treatments insured. Popular but non-core health treatments such as dental or physiotherapy can add to the cost of the policy, as well as the inclusion of specialist facilities in addition to the standard list of hospitals. Another factor is how much hospitals charge for treatment - sometimes there can be a large difference in cost between facilities, and as the insurance pays out more, the policy will likely be more expensive when it is renewed the next year. One more factor is the general level of inflation in the healthcare sector along with wider economic changes. An insurance broker truly giving advice can inform a company of the options and how to optimise the cost of their insurance, year-on-year.

-

Can businesses customise group health insurance plans?

Health insurance plans can be customised by a company in various ways. Firstly, it can segment its workforce into different categories, offering different levels of cover to each. For example, management may have a different range of benefits to non-management. These segments are called categories. A plan can also be customised by the range of treatments covered, the facilities included in the network, the range of countries a member can access treatment, and the duration of the plan, among other variables.

-

Can I purchase group health insurance online in Dubai?

Companies can browse options and purchase a health insurance policy online. To find the right policy that meets the benefits and budget requirements of the company and solves and processing issues, however, it's recommended that an advisory company (broker) be consulted.

-

What are the requirements for a business to qualify for group medical insurance?

Typically a company must have at least six employees on its census to qualify for a group health insurance plan, though there can be exceptions to this depending on the insurers under consideration. A company will need to submit copies of its constitutional documents, such as trade licence, and identification of its members, among other documentation.

-

Can a company change its group health insurance provider mid-term?

A company can change its health insurance provider, but it is unlikely it will receive any rebate of the initial premium paid by doing so.

© 2025 AES Middle East Insurance Broker LLC