Inflation is known as the silent killer.

You think your money is safe in cash but its value is being eaten by termites.

The key to stopping this is understanding the difference between ‘uninformed risk’ and ‘informed risk’.

Most people underestimate the consequences of small losses.

How aware are you that keeping your money in cash is not nearly as safe as you think?

Here’s why.

In May, fears about rising inflation in the US hit financial markets after consumer prices recorded their biggest annual jump since 2008.

There are two key reasons this happened:

- High government spending on COVID support programmes, coupled with a build-up in consumer savings, put more money in people’s pockets, driving demand and prices higher.

- Fear of high inflation on the horizon (as it’s been very low for a long time).

What does inflation mean for you?

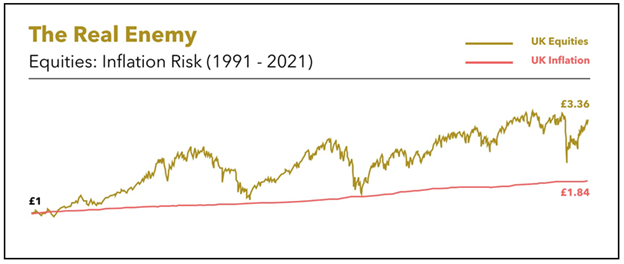

Although stocks bring risk and volatility, they also have a track record of providing inflation-beating returns over time.

Investing in stocks not only helps you grow your retirement savings but also helps your wealth last throughout retirement.

Once you're retired and out of the workforce, if your nest egg isn't growing, there's not much you can do to preserve your purchasing power if inflation hits.

As an investor, you’ll hear about nominal returns and real returns.

A nominal return is the return without adjusting for inflation.

Which means a high nominal return doesn’t guarantee a real profit.

A real return, on the other hand, is performance over and above inflation.

It’s what investors looking to increase their wealth should care about.

Lower inflation is typically good for investors, because it’s a sign of economic stability—an environment where financial markets tend to flourish.

Although high inflation hurts an economy, deflation, or falling prices, is not desirable either.

When prices are falling, consumers delay making purchases if they can, anticipating lower prices in the future.

For the economy, this means less economic activity, less income generated by producers, and lower economic growth.

Let’s look at this in context…

An international professional in the UAE retired in 2011 and repatriated to the UK.

He planned to spend £100,000 a year in retirement to enjoy his current standard of living.

To maintain the same level of purchasing power, he would need £125,000 today; 25% more than what he needed 10 years ago.

Finances in retirement are not linear.

The average inflation rate in the UK from 1991 to 2021 was around 2%.

On an annual basis, a 2% reduction may not seem like much.

However, over 25 years, it adds up to a 40% loss in real terms.

Not only will the value of your pot decrease over that time…

How you spend your money will also fluctuate depending on your life’s circumstances.

Some households will experience more pain than others depending on where they spend their money.

This is true even if inflation remains low because retirees are more likely to spend on things that tend to increase in price, such as healthcare.

Here’s another example…

Let’s say your parents bought their house for £50,000 in 1970 and sold it for £500,000 in 2010.

The majority of the £450,000 increase in value is simply the result of inflation.

Because the magnitude of inflation’s impact is not intuitive, it is often underestimated.

Summary

You can’t control the markets.

So prepare yourself for what you’ll do in case bad events happen.

Inflation is just one of many risk factors long-term investors need to be prepared for.

The best thing to do is to ensure you are self-aware around informed and uninformed risk.

Epic behavioural investment adviser, Andy Hart does a great job explaining the difference here.

Have a documented, detailed financial plan in place to ensure your money is working for you and outpacing inflation.

Understanding little differences now (such as losses from speculative bets, Bitcoin or market returns ‘not made’ because you’re in cash) can make gigantic differences later in life.

My point?

The best way to prepare for terrible periods in the stock market is by staying invested over the long haul.

No one knows if higher inflation is here to stay or not.

There are compelling arguments on both sides of this debate.

Regardless, the stock market is going to be underwhelming at some point going forward.

Many investors assume that means getting out of the market.

My advice to them?

This would be a guaranteed way to lose money to inflation.

By staying in the stock market over the long term, you’ll observe the incredible power of investing in the world’s greatest companies.

Stock market volatility is the price investors accept to get long-term returns.

75% of the time markets go up.

25% of the time markets WILL go down.

So choose which risk you wish to dance with.

Is it the overt risk of market volatility (which is easy to scream about) or the covert risk of inflation (the silent, invisible risk to short term thinkers)?

If you’re interested to hear more about inflation we recommend this article from two of the world’s greatest financial minds.