Ten years ago, the financial crisis hit.

The infamous global meltdown.

With the next one (apparently) looming…

What has the last decade taught us?

Dubbed the most catastrophic international collapse since the Great Depression …

2008 saw banks, mortgage lenders and insurers fail.

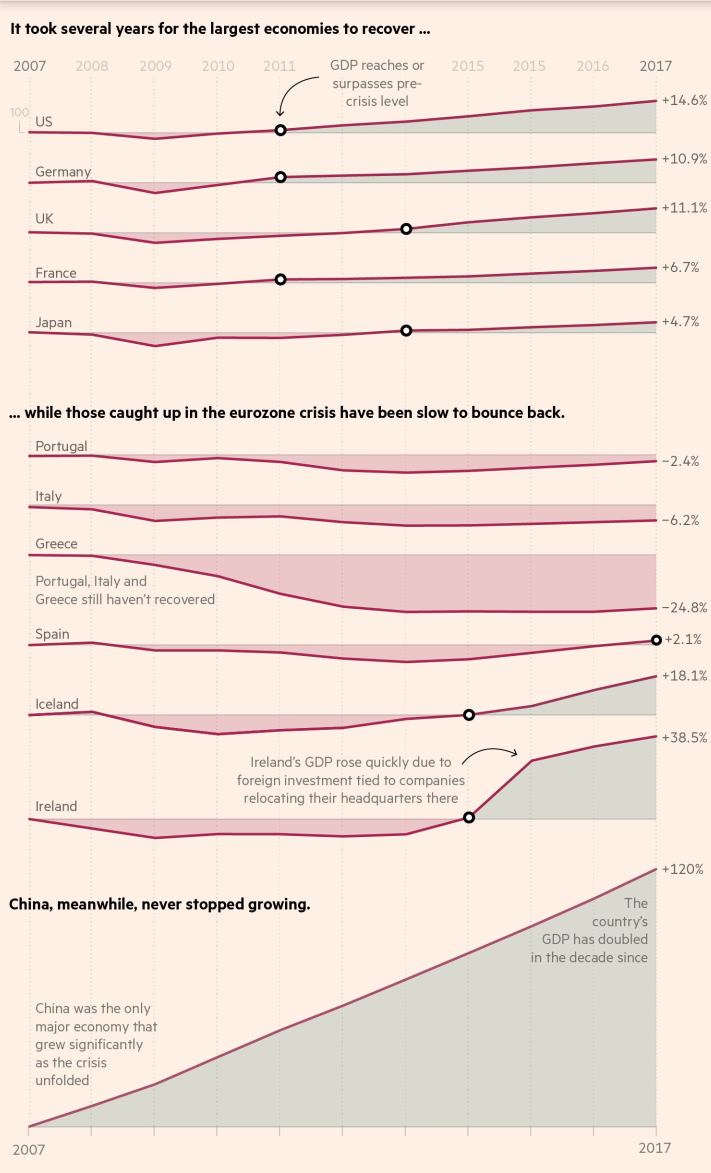

By 2009, economies making up three-quarters of global GDP were shrinking.

Drying up faster than puddles in a drought.

Doom and gloom.

But today most of the economies have recovered.

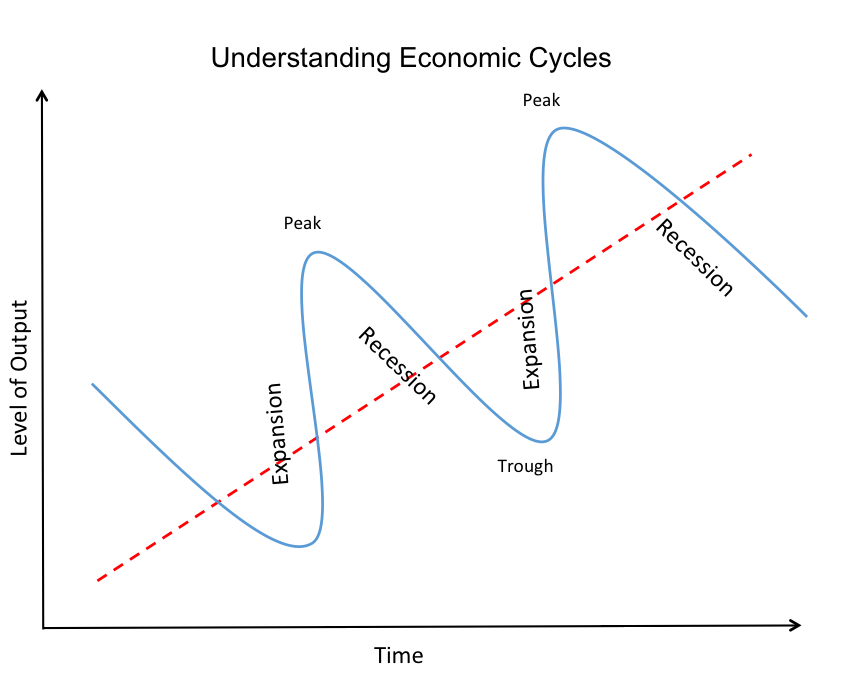

They have been through an economic cycle.

An economic cycle is the natural fluctuation of the economy.

It shifts between periods of expansion (growth) and contraction (recession).

Historically, expansion phases last around five years.

The latest phase has been going for ten.

As a result, economists warn a recession may be around the corner.

I’m not saying this to scare you.

On the contrary, now’s a better time than ever to reassess your goals.

To understand your investment behaviour.

See if you’re prone to irrational thinking in challenging times.

Queen Elizabeth II asked of the 2008 crisis:

“Why did nobody notice it?”

It’s a question that certainly instigated the I-told-you-so’s.

But rather than pointing fingers, it’s important to learn from the past.

Keep informed, educated and up to speed.

And safeguard ourselves, and finances, from outside catastrophes.

So, what have we learned?

Do’s:

- Stay invested. Patience is a virtue and reaps long-term rewards. Always remember your investment goals and stick to them.

- Protect your assets. Ensure the things you value are insured. Family, homes, cars, etc should be properly protected against life and economic events.

- Make sure your savings are safe and available when you need them. Offshore banking and investing could safeguard your money in a financial system that’s less likely to default.

- Cash is king. Keep some hard cash. This will serve as a buffer in times of emergency – especially if banks yield negative interest rates.

Don’ts:

- Don’t panic. The market will mend just like it did over the last decade. In 2008, panicked investors withdrew $140 billion from money market accounts in the United States. If withdrawals of this scale continued for a week, the entire economy would have halted. Proof that irrational behaviour can have dire consequences.

- Avoid taking out more debt. Keep your debt low and repayments affordable. According to The Guardian, unsecured debt reached £200 billion in 2018 for the first time since 2007. A new financial crash would hardly be surprising with debt of this size.

- Don’t withdraw your investments. Most of our investments are based on a long-term horizon. Cashing out when times get tough can have detrimental effects on your retirement.

- Don’t become complacent during calm waters. Evaluate your portfolio every 6 months or so to make sure it’s still working for you and getting you to your goals.

Recession-proofing your assets is a job that requires unbiased expertise.

Amazon best-selling author, Andrew Hallam, calls us the lifeboat of the international marketplace.

Give us a try and see how we can safeguard your assets against more challenging times (which may or may not happen soon).