One of my friends is a property investor.

His investments are all small UK based residential units.

He doesn’t believe in diversifying – and fair play, he’s been fortunate to have ridden a wave of decent yields – so far.

However, how might he fare if interest rates rise, property values fall, or rental demand decreases?

These are all threats to a property portfolio…and an undiversified investor, like my friend, is always at risk.

Investors and risk – a universal truth

All investors face risk.

Even index fund investors who eliminate the risks of individual stocks, market sectors and manager selection still face risks.

Diversification is the golden secret to balancing risk and returns…and the most important component in your wealth management that will enable you to reach your long-range goals, whilst minimising your risk.

Why is investment portfolio diversification so important?

There are times when a picture really does paint a thousand words.

Take a look at the following – at first glance it looks like a headache-inducing patchwork quilt…

But take a closer look…

It shows which was the best asset class in any given year over a ten-year period.

The patchwork-like dispersion of colours shows you there is no predictable pattern!

In other words, an investor with a specific asset allocation bias is at risk of poor performance at some point in their investing lifetime.

Investors who follow a structured and diversified strategy are more likely to capture returns wherever they occur in any given year.

But how should you diversify?

This is one of those questions that has an “it depends” type answer; it comes down to a consideration of asset allocation on a case by case basis.

Arguably, if you’re a single, high earning Generation Y professional, you could risk exclusive investment portfolio exposure to international equities.

By not diversifying from stocks, you could enjoy the highest returns over your investing life – despite the high level of risk you’ll also be exposed to.

On the other hand, if you’re a baby boomer planning to retire soon, being exclusively exposed to a single asset such as stocks is a risk too far for your retirement.

Different assets - such as bonds, stocks and property - will not always react in the same way to adverse events.

This is why your financial adviser might recommend a combination of asset classes to reduce your portfolio's sensitivity to market swings.

Bond and equity markets generally move in opposite directions – therefore a portfolio diversified across both can result in the risk of an unpleasant movement in one being offset by positive results in the other.

Another consideration is ensuring you’re diversified beyond the geographical borders of the country you live in.

How do you know if you’re properly diversified?

A set of accounts explain a lot about a company’s history, enable broad predictions about its future, and are critical tools for ensuring a business is fit and able to deal with any challenges or issues that come its way.

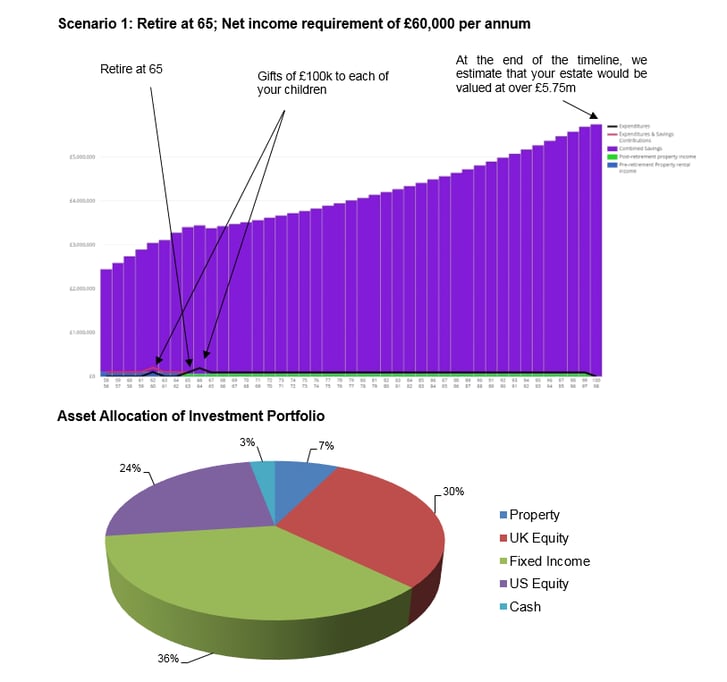

Similarly, an individual’s financial life can be better understood using a cashflow plan, and this should be the basis from which all long-term financial planning should begin.

A good cashflow plan shows the different assets you hold, their current value, how things might look in the future, and it helps your financial adviser build a realistic plan to support your goals.

A critical part of your cashflow plan will be examining whether you’re appropriately diversified.

Your adviser will factor in many personal aspects such as your age, risk tolerance and your goals when considering diversification.

Diversification and rebalancing

Diversification is critical in order to balance risk and returns – but it’s not a one-time task.

Once you have a target diversification and mix of assets, you need to keep on track - this may require occasional portfolio rebalancing.

If you don't rebalance, a good run in stocks could leave your portfolio with a risk level inconsistent with your goal, strategy and tolerance for example.

Rebalancing is not just a risk-reducing exercise – its objective is to reset your asset mix to bring it back to an appropriate risk level for you.

That might mean reducing risk by increasing the portion of your portfolio in bonds, but another time it could mean adding more risk to get back to your original target asset mix.