This couple lived in the most expensive city in the world... and still retired early

Seán and Sarah McHugh didn’t expect their tenants to damage their UK-based property.

But that’s what happened.

“I couldn’t believe how badly they treated our home,” says Sarah. “We had to spend so much money on repairs just to make it livable,” recalls Seán. “We were living in Singapore at the time,” he says. “We were paying an estate agent loads of money to look out for our property. But they did nothing. And because we were so far away, we had no idea what was happening.”

It was horrible. It was annoying. But there’s one thing the now-53-year old retirees didn’t have to worry much about.

They didn’t have to worry about money.

That might surprise you, considering these parents of two children (now 19 and 21) weren’t corporate executives. They weren’t lawyers or tech workers with gargantuan salaries. They weren’t business owners, either. Seán and Sarah McHugh were schoolteachers overseas.

No, they didn’t earn eye-watering salaries in a low-cost place like Bangladesh. Instead, they worked in Singapore. That’s where BMWs set fire to bank accounts. A 7 Series model costs a flame throwing $347,023 USD ($461,888 SGD). Honda Accords start at a scorching $170,992 USD ($227,999 SGD).1

Swiss banking corporation Julius Baer Group says Singapore is the world’s most expensive city. According to numbeo.com, the so-called Lion City is 52 percent pricier than Dubai for the same standard of living. Singapore is 26 percent more expensive than Sydney, Australia; and 37 percent more expensive than Vancouver, Canada.2

So how did Seán and Sarah retire at fifty-two, with a mortgage-free home in London?

For starters, they bi-passed new cars, choosing to drive a used, Mitsubishi Lancer in Singapore. They invested diligently every month and doused their mortgage with extra payments as often as they could. As their wealth grew, Seán paid $15,000 USD on a used Ducati motorbike that he chose to ride to work.

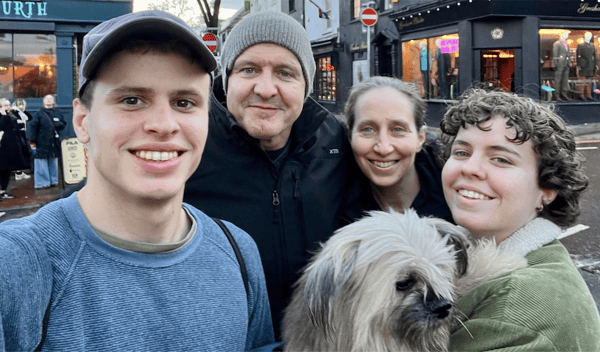

Photo: Sarah and Seán McHugh

Photo: Sarah and Seán McHugh

“We tracked our income and expenses on a spreadsheet,” says Seán.

“I think everybody needs to do that. It helps to treat your household like a business, to think in terms of your priorities and goals with respect to spending and saving. This helped us invest more money and pay off our mortgage.”

Some people think if they limit their number of restaurant meals or beers and margaritas, they’ll sacrifice happiness today for some date in the future. They might “normalize” a new car every few years and five star vacations. But happiness researchers say people like Seán and Sarah haven’t sacrificed a thing. “Stuff doesn’t make people happy,” says Seán. “Relationships and experiences do. We traveled a lot, but we didn’t stay at five-star places. We had just as much fun, though, as people that do.”

Photo: The McHugh Family

The couple always knew their greatest asset was time. It’s our only non-renewable resource. That’s why they planned to retire when they were forty-eight years old. They ended up four years shy of their goal, retiring when they were both fifty-two.

Seán and Sarah began investing for their future in 2010. They built a portfolio of index funds that’s now large enough for them not to work. While living in Singapore, they didn’t have to pay capital gains taxes on their investment gains. And now that they have repatriated their money to the UK, they pay a Lilliputian level of tax on withdrawals that’s hard to believe.

If, instead of saving and investing well, they had fallen into a spending trap, they would be sweating more today, based on a double lightning strike.

Two years ago, when they were still working, Sarah was diagnosed with breast cancer. Then, while she was recovering, Seán was diagnosed with a brain tumor. They still expect to be able to visit different countries, hug their loved ones, and metaphorically jump out of their share of airplanes for many years to come. But there’s no guarantee…for any of us.

That’s why I believe Seán and Sarah planned things right. They placed priorities where they should: on time and relationships. I’m not saying everyone should retire early, like Seán and Sarah.

But wouldn’t you like the choice?

Sources

Andrew Hallam is the best-selling author of Millionaire Expat (3rd edition), Balance, and Millionaire Teacher.