Could this chart from the 1800s give investors today a way to navigate unpredictable markets?

I'm not a fan of predictions, but let's take a look...

Back in the 19th century, an American pig farmer from Ohio called Samuel Benner may have discovered the secret patterns behind asset prices.

After seeing his own assets wiped out in the panic of 1873, he created a chart forecasting the rise and fall in the average price of hogs, corn and pig-iron, identifying an 11-year cycle in the former, as well as a 27-year cycle in the latter.

In 1875, he unveiled his 'magic formula' in Benner's Prophecies of Future Ups and Downs in Prices and since then, it's been spookily accurate at predicting the ups and downs of global stock markets, including the Wall Street Crash, the Second World War, and the dot-com bubble.

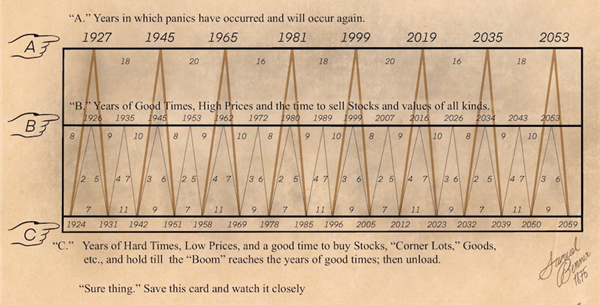

The cycle identifies moves based on three time sequences:

- Prosperity in a 16-18-20-year pattern (meaning you should expect 16 years between the first two prosperous periods, 18 between the next two and 20 between the following two, before going back to 16);

- Commodity price lows in an 8-9-10-year pattern; and

- Recessions in a 5-6-7-year pattern.

Download our free guide: Pursuing a better investment experience

"We can’t predict future economics. And even if we could, we can’t predict how people will respond to those economics. So, here’s my advice. Don’t seek opinions on Facebook. Don’t seek opinions on Reddit. Don’t seek opinions on CNBC. Turn off the noise. Invest as soon as you have money. And invest as regularly as you can."