I’m about to tell you the most remarkable story.

I’m sure you’ve never heard it.

It’s an incredible tale of perseverance.

With an important message for investors.

Look at this picture.

See the road in the middle cutting through the mountain?

Would you believe me when I told you it was built by one man…

With only his hammer and chisel?

It sounds impossible but it’s true.

In a remote town in the north-eastern part of India…

Villagers had to walk a treacherous 50km around the mountain…

For supplies or medical treatment.

One day, a villager named Dasrath Manjhi…

Made it his mission to carve a path through the mountain.

Starting in 1960, he slowly started chopping away…

Day by day, for 22 long years.

Local villagers mocked him for having such an ambitious dream.

But he blocked out the noise…

And finally finished the path in the 1980s.

He earned himself the nickname of “Mountain Man”.

His years of perseverance created a path…

That made medical access easier for village residents…

And cut down travel distance from 55km to 15km.

Long-term goals are always worth it in the end

“Mountain Man” had a long-term goal.

Come hell or high water…

He was determined to achieve it.

Investors can understand…

The wonders that a long-term view can have.

We live in an impatient world.

We’re bombarded by messages like…

Invest now.

Buy this now.

Book your holiday now.

They impact our behaviour.

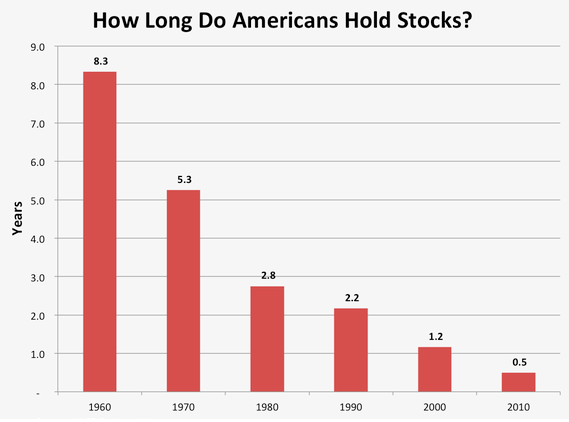

I found a graph showing the average holding period for stocks by Americans.

They’ve been decreasing over time from 8 years in the 1960s to 6 months in 2010.

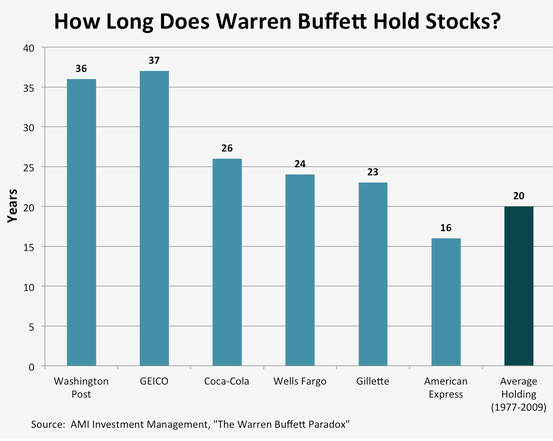

Warren Buffet’s average holding period?

20 years.

(Interestingly… the same length of time it took to build the road in India).

One of the world’s greatest investors…

And his patience certainly paid off – a billion times over.

The benefits of long-term investing

Investments held for longer periods…

Tend to have lower volatility than short-term ones.

The longer you invest…

The more likely you are to weather any fluctuations in the market.

Typically, with time on your side…

You can take on more risk…

To get better returns.

Historically, long-term views have reaped incredible rewards.

John C. Bogle…

Benjamin Graham…

And Sir John Templeton.

Their fame and fortune speak for themselves.

Quite honestly, I rather prefer a buy-and-hold approach…

It’s certainly a lot less stressful…

And gives me more time to focus on other important things in my life…

What about you?

If you’re looking for long-term solutions…

Or a financial planner to partner with for many happy years…