Time is ticking: here's how to make the most of today without sacrificing tomorrow

As a senior international executive, you're most likely struggling to balance work with family and life.

Time is a valuable resource.

It helps you create better relationships, have greater success at work and more memorable moments.

But it never feels like you have enough of it.

Am I right?

Before I move on, let me say...

I completely understand.

I'm a business owner, married with three kids.

After work and on weekends, I lead an active lifestyle of cycling and activities with my family.

Time seems to tick by in a flash.

It's why what I'm about to share is so life-changing.

Each day, you'll hold yourself accountable to make every moment count.

Hat tip to Wait But Why for this post.

It's shaped how I view my time and money as a result.

Money helps me achieve my goals, give my children a head start in life and have the retirement I dream of.

Time, used wisely, makes them happen.

I'm sure it's the same for you.

The blog lays out the human lifespan visually by years:

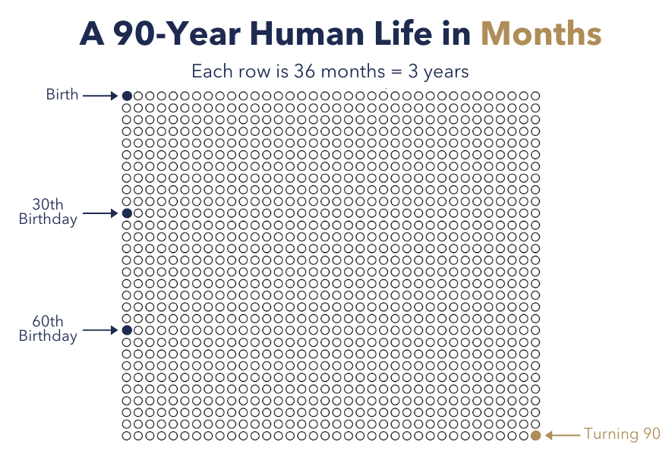

Here's what it looks like in months...

Here's what it looks like in months...

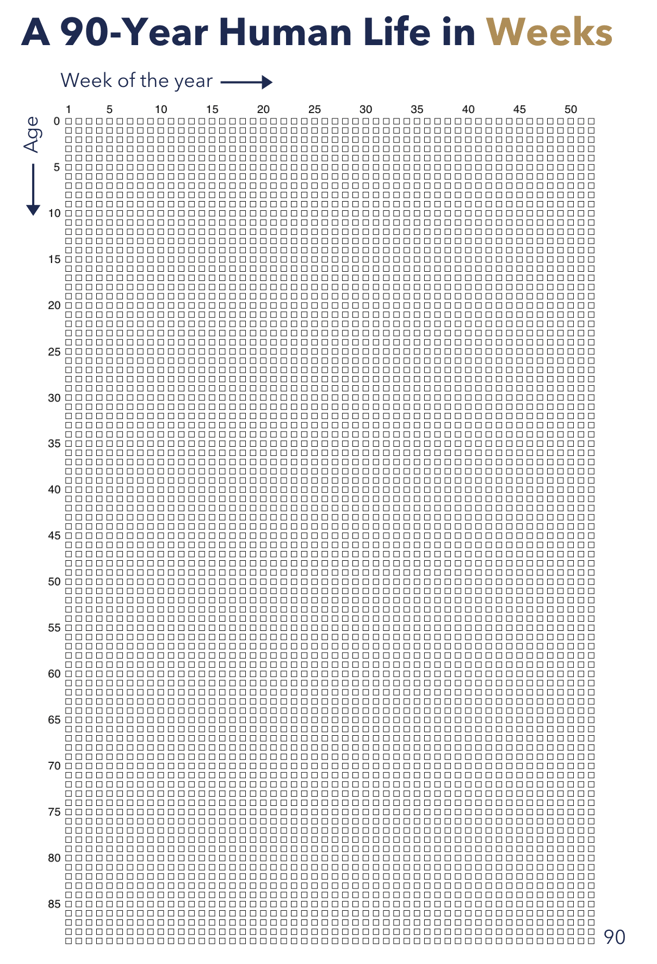

Weeks...

Weeks...

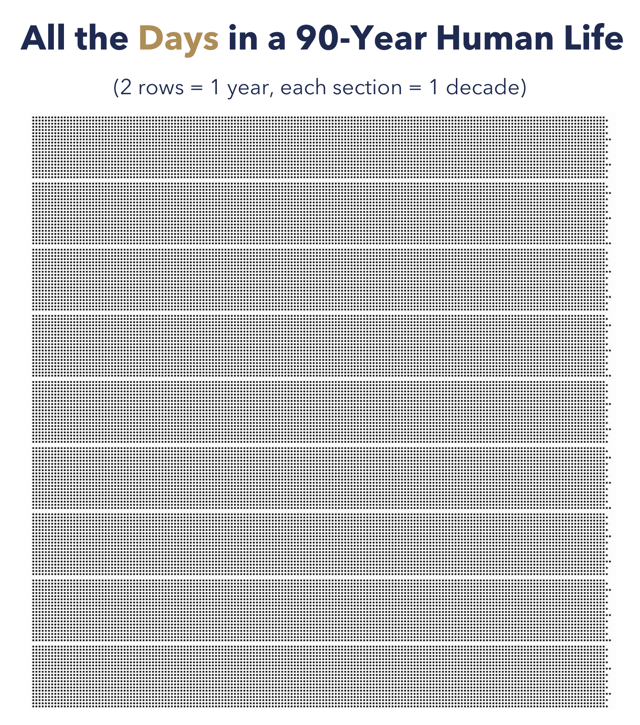

And days.

And days.

This may not be easy to grasp...

This may not be easy to grasp...

But the maximum number of days you can hope for in your entire lifetime fits easily on a single page.

While days flutter by, memorable moments and events remain top of mind.

To illustrate this, let's take a look at a typical senior executive from the UK, living in Dubai.

We'll call him Michael and he's 44 years old.

Being as optimistic as possible, he can hope to live to about 90.

Meaning he has a little under 50 winters left:

Since it doesn’t snow in Dubai...

Unless Michael travels back to Europe every winter this might drop to 20 (a winter visit every other year).

Given the chance of getting a white Christmas in London is just 6% or 1 in 20 (and probably decreasing), the odds are he has just one shot left at a white Christmas in his life.

Michael likes to tune into Wimbledon because it reminds him of home and his tennis days when he was at university.

He hopes to have the opportunity of watching a further 46 finals...

In terms of general elections, there've been 8 during Michael’s lifetime and about 9 to go.

Michael and his wife enjoy a luxury trip twice a year.

So they have at least 92 chances to see the world together.

When he reflects upon his life as a senior executive living abroad...

He knows there are, and will be, sacrifices along the way.

Sacrifices that often come in the form of time.

-2.png?width=960&name=Blog%20images%20(1)-2.png)

Relationships

Let’s consider Michael’s parents (who are in their mid-70s).

During his first 18 years, he spent time with his parents during at least 90% of his days.

But since heading off to university, getting married and later moving abroad, Michael’s probably seen them an average of only five times a year, for an average of maybe two days each time.

10 days a year.

About 3% of the days he spent with them each year of his childhood.

Let's continue to be optimistic and say Michael is one of the incredibly lucky people to have both parents alive as he nears retirement.

That would give him about 20 more years of coexistence.

If the ten days a year basis holds, that’s 200 days left to spend time with them.

Less time than he spent with them in any one of his 18 childhood years.

The harsh reality is that while you're not at the end of your life, you may be nearing the end a loved one's.

This is not meant to scare you but inspire you to see life differently.

And to make the most of the time you have left on this planet.

To achieve that, I'd like to share 3 quick strategies with you.

#1: Have no regrets

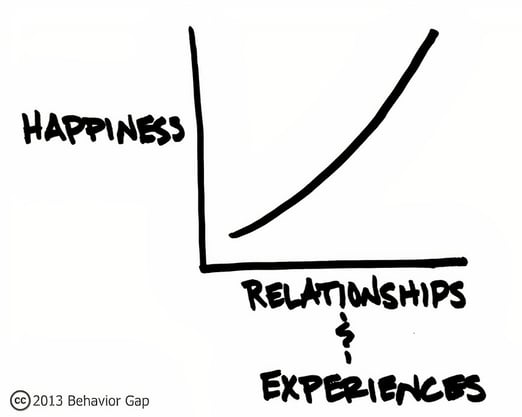

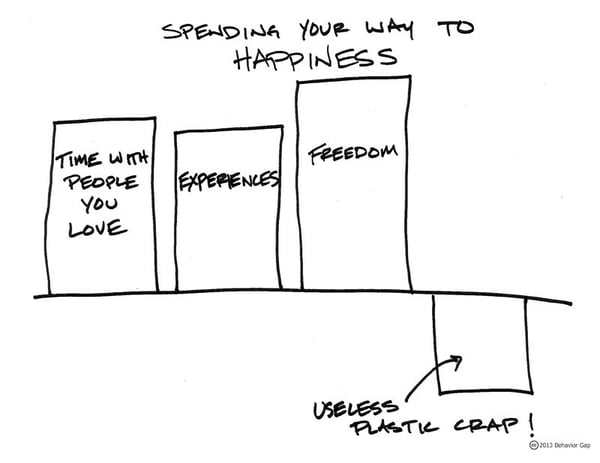

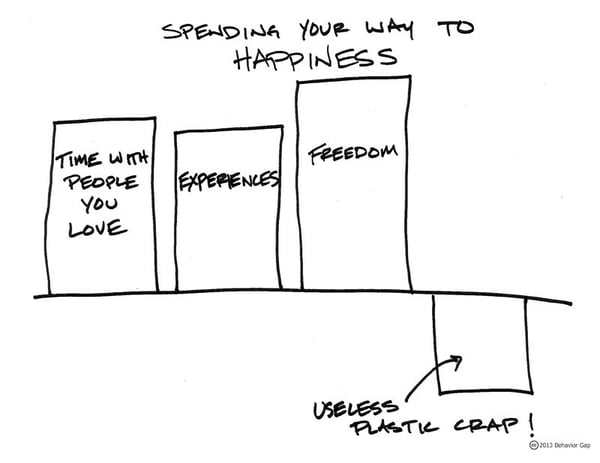

Happiness comes from having strong relationships and/or great experiences.

I know it's important for you to spend time with your loved ones now and in the future.

You want to achieve this without having to sacrifice too much (or anything at all).

The best of both worlds.

With proper financial planning, it can be done.

As long as you stick to a few simple rules:

- Spend less than you earn

- Take a long-term view

- Avoid reacting to the media

#2: Remember time flies

It really does.

It’s hard for us to put the future into perspective because we are so focused on today.

Hopefully after reading this, you'll have a better perspective on what's truly valuable in your life...

And what money means to you.

From there, you'll be able to have a better relationship with your money, meaning better control of your future.

Even for executives like yourself, who are high-earners and enjoy the finer things in life...

Keeping a grip on your spending makes the world of difference.

Just ask Warren Buffett.

#3: You need to make time count

#3: You need to make time count

Money doesn't buy happiness but it can help you afford the future you deserve.

That, and the many memorable moments along the way.

What's important is to empower your financial decisions so you can have a happy, healthy and prosperous life.

It starts with having access to unbiased and trusted financial education.

Whether you want to read a blog a week.

Watch a video a day.

Download a handy guide, like 11 rules high-net-worth investors swear by, whenever you need it.

Or listen to a podcast on the go.

AES Education is a rich source of information for anyone wanting clarity, confidence and control over their ideal futures.

Who knows, the knowledge gained may get you to your goals sooner.

It may even buy you a little more time to have more enriching experiences.

#3: You need to make time count

#3: You need to make time count