According to research, there are three types of "money minds".

Fear, happiness and commitment.

Once you know which of those minds applies to you, you’ll be able to manage your finances and make better decisions.

Last week, my colleague Stuart talked about those with a fear mindset.

This week, I'm looking at those driven by happiness.

Sound like you?

If so, you are classed as “pleasure seekers.”

You're all about enjoying today.

Thinking about the need to save often makes you frustrated and impatient, though — and, as a result, you often feel you don’t have enough money.

Morgan Housel once said,

"Money buys happiness in the same way drugs bring pleasure: Incredible if done right, dangerous if used to mask a weakness, and disastrous when no amount is enough."

You’re probably not too anxious about the future, but you don’t spend enough time evaluating financial decisions.

Have you ever stopped to think why happiness drives your financial decision-making?

Lessons from the longest study on happiness

If you think it's fame and money keeping us happy and healthy, you're not alone.

But, according to psychiatrist Robert Waldinger, you're mistaken.

As the director of a 75-year-old study on adult development, Waldinger has unprecedented access to data on true happiness and satisfaction.

In his TEDx talk, he shares three important lessons learned from the study as well as some practical, old-as-the-hills wisdom on how to build a fulfilling, long life.

Essentially, good relationships keep us happier and healthier.

- Social connections are really good for us. Loneliness kills.

- The quality of your close relationships matters

- Good relationships don't just protect our bodies - but our brains (and the people in relationships where they feel they really can't count on the other one, those are the people who experience earlier memory decline).

If these are the real drivers of happiness, ask yourself...

Is your enjoyment of today helping or hindering your relationships?

Are you making careless money decisions at the detriment of those around you?

Remember, money is simply a tool to be used.

Unpredictable events have a deep and lasting impact on happiness

I recently read The Black Swan by Nassim Taleb.

Through a number of examples, Taleb aims to show his readers how rare and unpredictable events have a deep and lasting impact on a person's life...

And happiness.

For example...

Making $1 million in one year, but nothing in the preceding nine, does not bring the same pleasure as having the total evenly distributed over the same period, that is, $100,000 every year for ten years in a row.

The same applies to the inverse order – making a bundle the first year, then nothing for the remaining period.

In this case, your happiness depends far more on the number of instances of positive feelings, what psychologists call “positive affect,” than on their intensity when they hit.

Plenty of mildly good news is preferable to one single lump of great news.

So to have a happy life you should spread these small “affects” across time as evenly as possible.

By the way, the same applies to your unhappiness.

It's better to lump all your pain into a brief period rather than have it spread out over a longer one.

Those with a financial planner are statistically happier than those without one

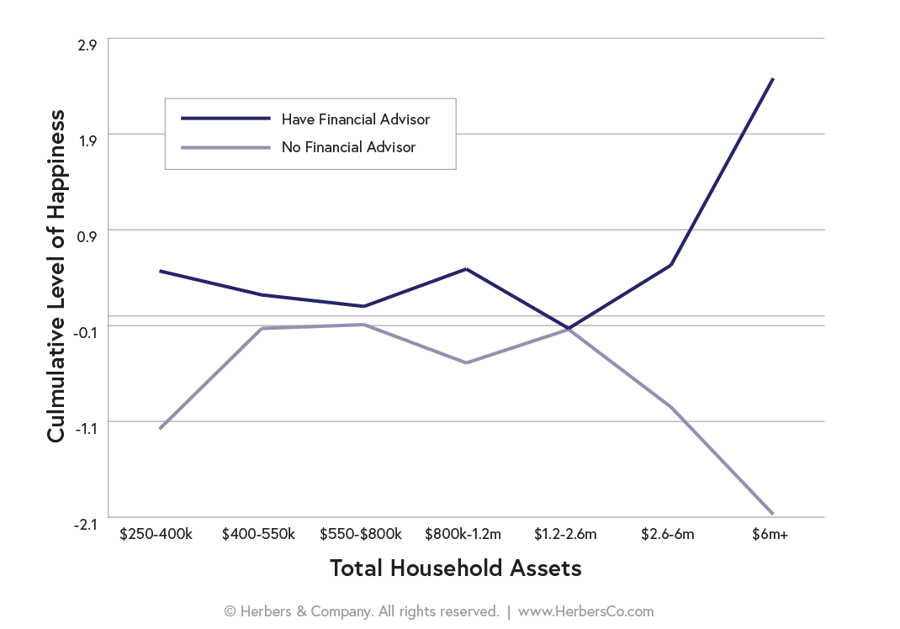

For those with $1.2m or more of assets, a recent study has shown that those with a financial planner were statistically happier than those without one.

This survey of 1,000 random consumers across the US...

(All of whom had self-reported assets of $250,000 or more),

Consisted of a list of 43 statements to gauge the level of consumer happiness.

It identified four core factors that make people happier: fulfillment, intention, impact and gratefulness.

All four predictors of happiness were heightened among consumers who work with financial planners—by a wide margin.

As individuals move past $1.2 million of assets, those who work with financial planners rapidly increase in happiness, while those without planners rapidly become less happy.

It seems, for individuals with more than $1.2 million in assets, a financial planner is critical to happiness.

Money is deeply personal and emotional.

If you think happiness is the key driver of your financial decisions, talk to you friends and family about it.

Tell your financial planner.

Factor it into your financial plan.

The way you feel about money affects your entire life.

Time to make smarter decisions for the future.