Last week, I downloaded Apple Pay.

I found it revolutionary – and began to wonder if I’d ever use cash again.

But in this increasingly cashless society …

Are we in danger of spending too much?

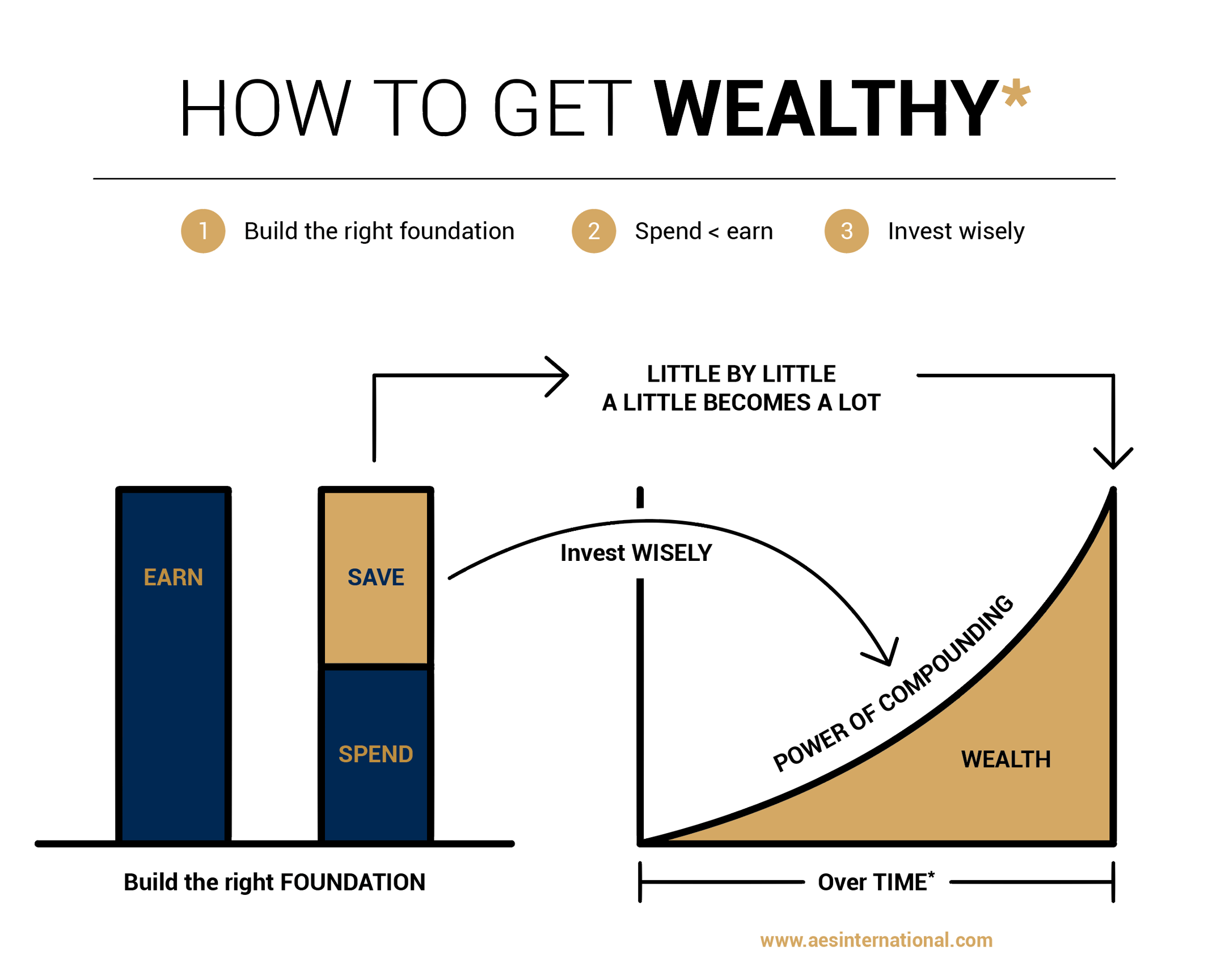

It’s ironic, but despite the torrent of self-interested articles and salespeople who encourage ‘savings’ - prudent spending rates matter more than savings rates.

See step 2:

Most households struggle to save.

There is no money left at the end of the month to save in the first place.

Technically their problem isn’t a savings problem that is too low, it’s a spending rate that’s too high.

The available household income tends to be consumed before the end of the month is even reached!

While contemplating if I could pay for my children’s school fees via Apple Pay …

(And ultimately drown myself in air miles points)

I stumbled upon an interesting article about the ‘pain of paying’.

It suggests we are more aware of spending when it’s with physical money.

Parting with cash may even ‘hurt’ a bit more than swiping a credit card.

Or in my case, simply tapping my phone.

The interaction of paying and consuming

In 1998, academics in the United States examined the pain of paying.

They argued that people feel differently about payments when there is a gap between purchase and consumption.

Digital payments alter the point at which the pain of paying happens.

Tempting us to enjoy the goods or services now and only feel the pain when the bill arrives later.

In 2008, a paper called Monopoly Money took the discussion one step further.

Academics argued the pain of paying was not only related to timing.

But to mode of payment as well.

Non-cash alternatives were associated with higher spending.

Which may be due to people finding it difficult to think of cards as cash.

People treat it like Monopoly money.

A study published in the Journal of Consumer Research in 2010 examined actual payment records from a large retail outlet.

They found people using credit cards typically spent more on impulse purchases.

Those who had previously been in control of their spending …

Were susceptible to spending more.

Suggesting credit cards reduce the pain of paying.

(Even with those who keep an eye on what they spend.)

More spending could lead to less saving

With my credit cards readily available at the click of a button…

My days now play out to the tune of tap, tap, tap.

Cappuccino? Tap.

Lunch? Tap.

Gift for my wife. Tap … tap.

Dilip Soman is a professor of marketing at the University of Toronto.

He studies behavioural economics.

While in a Hong Kong café, he made an interesting observation.

Those paying with contactless cards, instead of cash, splurged more on drinks and desserts.

“When money is abstract, it’s easy to lose track of it”, he says.

That’s because with convenience comes more consumption.

In a single year in the UAE:

AED 216 billion (£ 46 billion) was splurged using credit, debit and prepaid cards.

- There are 164 million payment cards in circulation

- 32 million adults with a credit card

- Credit card transactions totalling £50.7 billion (in 2017)

A completely cashless society won’t be happening any time soon, though.

According to the Financial Times, there are still 500 billion banknotes in circulation.

Keep focussing on your goals

At the end of the day, we’re all human.

We make mistakes.

Give into temptation.

Search for convenience.

But it’s important to always remember: spend less than you earn.

It’s our second step to achieving your financial freedom.

If you’re having trouble staying on track of your investment goals, let us give you some helpful advice and tips to keep you on the right path.

Chat to us online or submit an enquiry and one of our associates will be in touch to discuss your needs – without obligation.