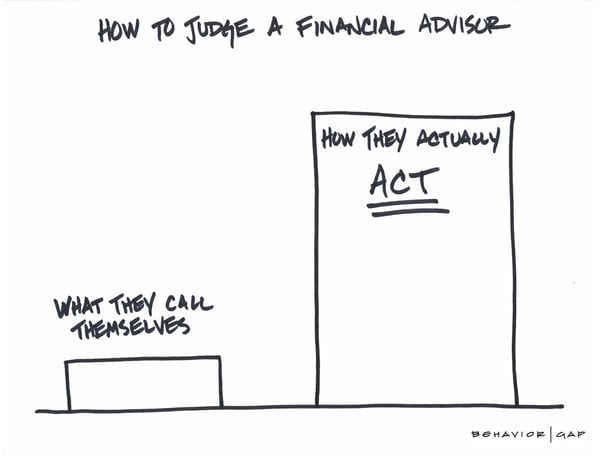

What’s in a name?

In financial services, a lot actually.

Identical labels, job titles and service descriptions often mean completely different things.

Making it extremely difficult for the untrained eye to decipher.

But understanding the real differences is critical to what you get.

Do you need a broker, an investment adviser or a financial planner?

What’s the difference between a wealth manager, an IFA, a Chartered Financial Planner?

Do you want financial advice, help with investing, comprehensive financial planning, independent advice or just a product?

Labels are often used interchangeably…

But the nature of the services provided are often vast.

Generally speaking…

1. Brokers sell products full of securities…

And make their money through commissions generated by buying and selling these products and investments.

They may often call themselves advisers, planners or IFAs within unregulated markets…

But tend to vend the products that pay them the most commission while appearing to ply their trade for ‘free’…

2. Investment advisers help people choose where to invest their money…

For either a commission or a fee (sometimes sadly both).

3. Financial planners help investors prepare personalised strategies for life events…

These may also include specific goals, such as retirement or buying a house but also cover how to protect existing positions.

But this can get way more complicated

Many people who you may consider investment advisers…

Are actually investment brokers…

(Just as some ‘planners’ are actually investment advisers in disguise).

To further confuse matters…

Most financial planners are also investment advisers…

But only a few investment advisers actually deliver comprehensive financial planning services (which usually involve insurance).

Financial planners, of course, are available in numerous makes and models.

Some provide advice on just a single topic…

(Such as retirement, tax, property or life events)…

While others offer comprehensive financial planning services.

Some are independent and represent your best interests and others are tied and represent the interests of a product provider.

Rest assured, they will likely all say they can do everything.

(I know, it’s all a bit of a tailspin).

It’s simpler than it seems

To find someone who can help guide you…

Begin the search with a strict focus on what you want.

- Are you a DIY investor wanting a little help to buy or sell a security?

- Do you want to hand over a lump sum and delegate investment decisions to a professional?

- Are you planning your estate, your retirement or purchasing insurance to protect your loved ones?

- Do you need guidance in creating a financial plan that includes all of these, and more?

Once you have a good idea of the types of services you need…

You will be better prepared to find the right type of provider.

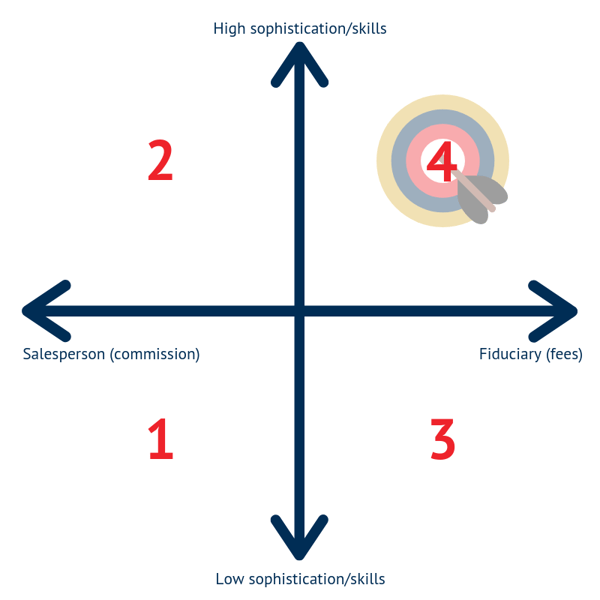

Not ALL advisers are created equal

Once you understand that job titles or service descriptors don’t mean much…

And HOW each firm acts is more important…

You will realise most financial people fall into one of four quadrants.

1. The salesperson with inadequate skills

1. The salesperson with inadequate skills

These ‘advisers’ are like hurricanes…

Unaware of the damage their forceful natures can cause.

Typically recruited from strong sales backgrounds without an ounce of technical experience…

These self-employed drones try to vend as many products as possible.

The more products they shift – the more they earn.

Potentially this creates an incentive for them to act in their best interest…

(Not yours)...

And sell inflexible and poor-performing products that lock you in…

So they can line their own pockets.

And not yours.

They often find you by cold-calling.

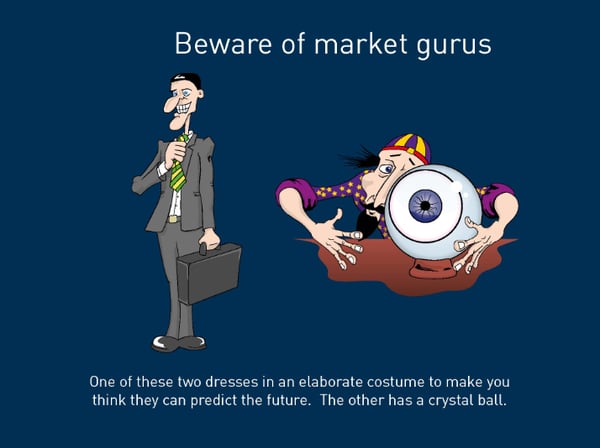

2. The highly sophisticated salesperson

This ‘adviser’ offers an opinion on everything.

They talk the talk…

And walk the walk…

With a sportscar to get them from client to client.

They are polished salespeople who will lure you into buying the next big thing…

With lofty promises and a game of golf.

But don’t be fooled by their charms…

And, certainly, don’t take out your chequebook.

These charismatic salespeople are the best ‘survivors’ of the former bunch.

They will have developed a network of golfing or drinking friends…

And decided that referral marketing works best.

They will typically offer a suite of ‘special offers’…

Like structured products, offshore pensions and bonus allocations…

To get you to sign on the dotted line.

3. The unsophisticated fiduciary

These individuals tend to have been around the block…

And realised the flaws of the former two operating models.

Typically, these breakaways are one-man bands or ‘cottage industry’ firms who build a niche…

And want to do a better job.

But, they often lack the resources for research, compliance, technology, scale and service.

Struggling without infrastructure…

They tend to focus on investment advice (because it pays them) and not upon you.

They’re a far better option than the former two profiles and will likely get you good results.

But an investor looking for an adviser to help them plan both their lives and finances…

May be left feeling short-changed.

4. The skilled fiduciary

Or, as I like to think of them…

The ‘future’ of financial services.

These advisers work for ensemble firms…

Which are comprised of many multi-disciplinary professionals.

They are individuals who possess the know-how…

Emotional intelligence…

Certifications…

And a person-centric not money-centric approach…

To help you as an individual fulfil your life goals.

They offer the widest breadth of comprehensive services in a high-risk-controlled manner.

This adviser works for a full-fledged firm…

That offers comprehensive planning, independent advice, an investment philosophy and technologically enabled service…

So your investment isn’t linked to an individual…

(In case he/she gets hit by a bus or disappears overnight)…

But a trusted company.

Ask the right questions

At the end of the day, it doesn’t matter what people call themselves…

It’s about what they do…

The skills they have…

And how they act.

For those answers, you need to ask questions like…

How do they get paid?

What qualifications do they have?

How comprehensive are their plans?

And don’t be afraid to do so…

After all, you’re paying for their service and expertise (whether you know it or not).

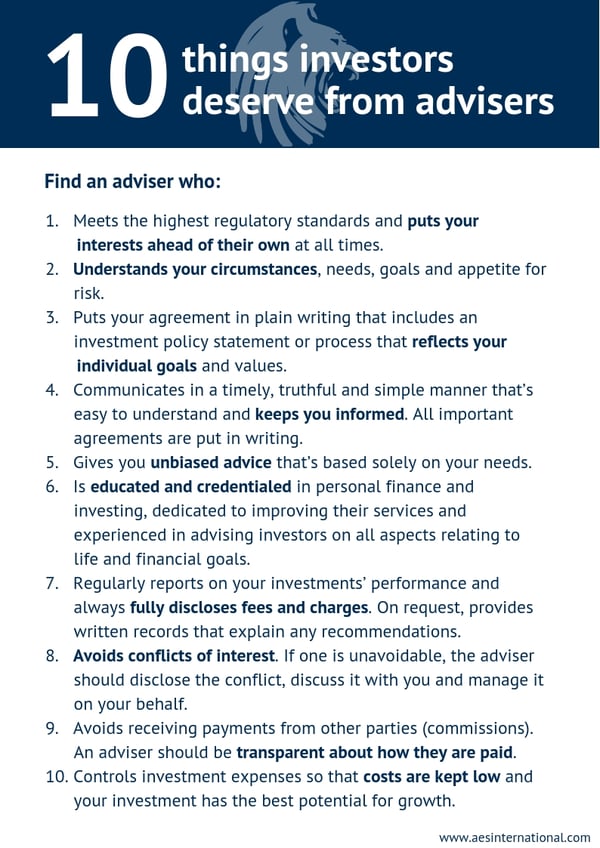

Here’s a 10-item checklist from The Institute for Fiduciary Standards we’ve found…

It sets out what you should look for if you want to get the best advice.

Our advice is to make sure the financial adviser you choose…

Ticks all these boxes.

If not, get a second opinion.

We can help.

It only costs 15 minutes of your time.