[Estimated time to read: 1 minute]

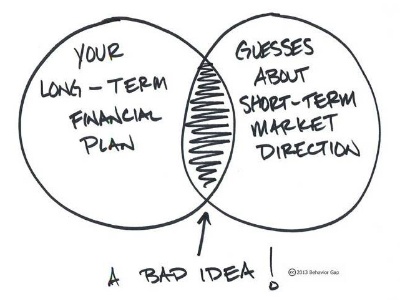

DON'T speculate, actively invest or try to guess the market because:

- Almost all US, global and emerging market funds have underperformed since 2006.

- 99% of actively managed US equity funds sold in Europe have failed to better the S&P 500 over the past 10 years.

- Only two in every 100 global equity funds have ever beaten the S&P Global 1200 since 2006.

DON'T save your money and expect it to grow:

- $13 today equals the purchasing power that $1 provided in 1926.

- If you’d saved $1 in the bank in 1926, you would have $21 today.

- If you’d put that $1 in long-term bonds, you’d still only have $132.

DO invest your money passively, remain disciplined, cut costs and focus on the long-term:

- If you’d invested $1 in the S&P 500 index in 1926 you would have $5,386 today.

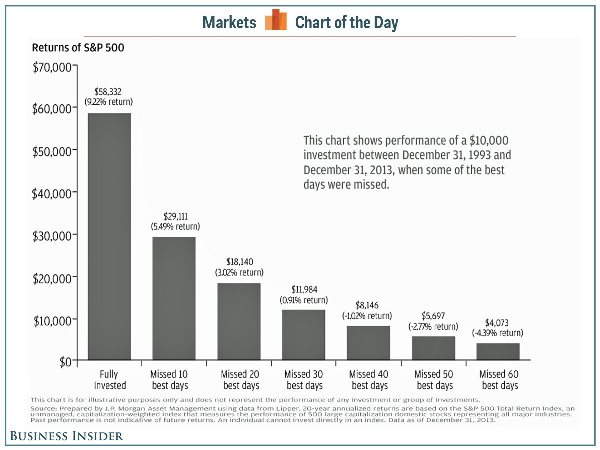

- In a study of the S&P 500, eight of the 20 best days happened within 10 days of one of the 20 worst days. Therefore, remain disciplined because jumping ship can cost you the market’s biggest gains.

- Index fund expenses are about seven times less than comparable actively managed fund expenses.

- Average passive investors earn 3% to 4% more annually than average active investors.

How you can make more money from your current savings and investments

Most expats can:

- Cut costs and fees.

- Get more flexible, penalty-free access to their funds.

- Make more money than they currently are by changing the way they invest.

If you’d like us to, we’d love to help you make these positive changes to your portfolio.